Table of contents

In this article, we will give you an overview of tax incentives in Vietnam to help you make the most out of opportunities that Vietnam offers for foreign investment companies.

Why invest in Vietnam

Although there are also many other reasons to invest in Vietnam, here are the three major drivers that attract foreign investors.

#1 Vietnam’s young and growing population

Firstly, the median age in Vietnam is 30.9 years, according to Worldometers. Furthermore, Nielsen even estimates that 60% of the Vietnamese are under the age of 35. This means that more than half of the population is at its most vigorous working age.

There are more than 96 million people living in Vietnam and the number is growing rapidly. Vietnam’s population has already exceeded the population of larger European countries. In addition to an increasing population, the solvency of the Vietnamese is also growing together with the GDP.

#2 Low setup and labor costs in Vietnam

Secondly, as there is no official minimum capital requirement in Vietnam, foreign investors can set up a company without having tons of money in their back pockets. However, note that the injected charter capital must be in compliance with your planned expenses.

Despite being on a constant rise, minimum wages in Vietnam still remain relatively low, compared to other countries in the region, such as China. In fact, lower labor cost is one of the main reasons many investors are already moving manufacturing from China to Vietnam.

For example, the minimum wage in Vietnam’s highest-paying region is 3,980,000 VND/month (approximately US$175) in 2018 in contrast to China’s 2,420 CNY (~US$384).

#3 Vietnam’s openness to foreign investment

Thirdly, Vietnam’s government executes a welcoming attitude towards foreign investment and is continuously changing its regulations to boost foreign investment in Vietnam.

These benefits include reduction or even exemption from the following taxes:

- Corporate income tax

- Import tax

- Land rental or land use tax

These incentives are available for investors who invest in certain geographical areas or engage in sectors of special interest.

Taxes in Vietnam

Corporate income tax

Vietnam imposes a standard corporate income tax (CIT) at a 20% flat rate. However, if the business engages in highly-encouraged sectors or geographical areas, it is subject to corporate income tax incentives in Vietnam.

One of the main reasons why a lot of investors opt for Vietnam instead of any other market in Asia is Vietnam’s competitive corporate taxes.

|

Country |

Corporate income tax rate |

|

Vietnam |

20% |

|

Malaysia |

24% |

|

China |

25% |

|

Indonesia |

25% |

| Philippines |

30% |

Source: Trading Economics

Value-added tax

Value-added tax is applied to goods and services and can be either 0%, 5%, or 10%. In most cases, the VAT is levied at a 10% rate.

Note that all companies have to submit outcome VAT when they sell their goods and services. A lot of companies refuse to issue VAT invoices if you don’t request for them before or on the same day of the purchase.

In fact, not asking for VAT invoices is one of the common mistakes foreign investors do in Vietnam.

Personal income tax

Personal income tax (PIT) in Vietnam is progressive for both local and foreign residents. The PIT rates in Vietnam vary from 5-35%, depending on the income of the individual.

Non-residents, however, are subject to 20% flat rate of personal income tax.

Business license tax

All companies in Vietnam also have to pay the business license tax. The amount of the tax depends on your registered capital. It can range from ~US$44 – US$135 and it is paid annually.

Read more about tax planning in Vietnam.

Corporate income tax incentives in Vietnam

As already mentioned, most companies in Vietnam are taxed at a 20% corporate income tax rate. However, there are tax incentives available, depending on the industry and location of your business. In other words, sectors and locations that are highly encouraged by the government receive CIT incentives.

There are two main types of tax incentives in Vietnam:

- Preferential tax rates – reduced tax rates

- Tax holidays – tax exempted for a certain period of time or throughout the project

Reduced tax rates in Vietnam

In some industries, the corporate income tax can be reduced for the whole period of operation.

|

CIT rate throughout operation |

Projects that are eligible |

|

10% |

Planting, tending and protection of forests, cultivation, husbandry, aquaculture, agriculture, aquatic product processing in areas with difficult socio-economic conditions |

|

15% |

Cultivation, husbandry, processing in agriculture and fishery in areas without difficult socio-economic conditions |

|

17% |

People’s credit funds, cooperative banks, microfinance institutions |

Tax exemption in Vietnam

However, there are also industries in which companies are eligible for corporate income tax exemption for a certain period of time in addition to subsequent tax reduction.

Some investment projects can enjoy CIT exemption in Vietnam for the first 2 years and proceed with reduced tax rates as follows:

|

CIT rate |

Projects that are eligible |

|

No CIT for the first 2 years |

Production of high-grade steel, energy-saving products, machinery and equipment for agricultural, forestry, fishery and salt production, irrigation equipment, animal feed, poultry and aquatic products, development of traditional trades in areas with difficult socio-economic conditions (except industrial parks which already have favorable conditions) |

|

8.5% for years 3-6 |

|

|

17% for years 7-10

|

|

|

20% for years 11+ |

Others, on the other hand, can get CIT exemption even for the first four years and enjoy the reduced tax rate for the subsequent years, depending on their location.

|

CIT rate |

Eligible projects |

|

No CIT for years 4 |

Education and training, job training, health, culture, sports and environment, real judicial expertise in areas with difficult socio-economic conditions |

|

5% for years 5-13 |

|

|

10% for years 14+ |

|

|

No CIT for years 1-4 |

Education and training, job training, health, culture, sports and environment, real judicial expertise in areas without difficult socio-economic conditions |

|

5% for years 5-9 |

|

|

10% for years 10+ |

Tax incentives for companies in the high-tech sector are shown in the table below among other projects:

|

CIT rate |

Projects that are eligible |

|

No CIT for years 1-4 |

Scientific research, technological development, high-tech nursery, high-tech enterprise incubation, venture capital for high-tech development, construction investment, environmental projects. Companies that apply high technology or are registered in especially difficult socio-economic conditions, economic zones, high-tech parks, including concentrated IT zones established under the Prime Minister’s decision Production of products on the high-priority list |

|

5% for years 5-13 |

|

|

10% for years 14-15 |

|

|

20% for years 16+ |

High-priority products in Vietnam

As stated in Decree No. 111/2015/ND-CP, investment projects that involve manufacturing of materials, accessories, components, and spare parts used for assembling goods in certain industries are also eligible for tax incentives in Vietnam.

This concerns the following industries:

- Textile and garment industry

- Footwear and leather industry

- Electronics industry

- Automobile industry

- Mechanical fabrication sector

- Supporting products used in high-tech industry

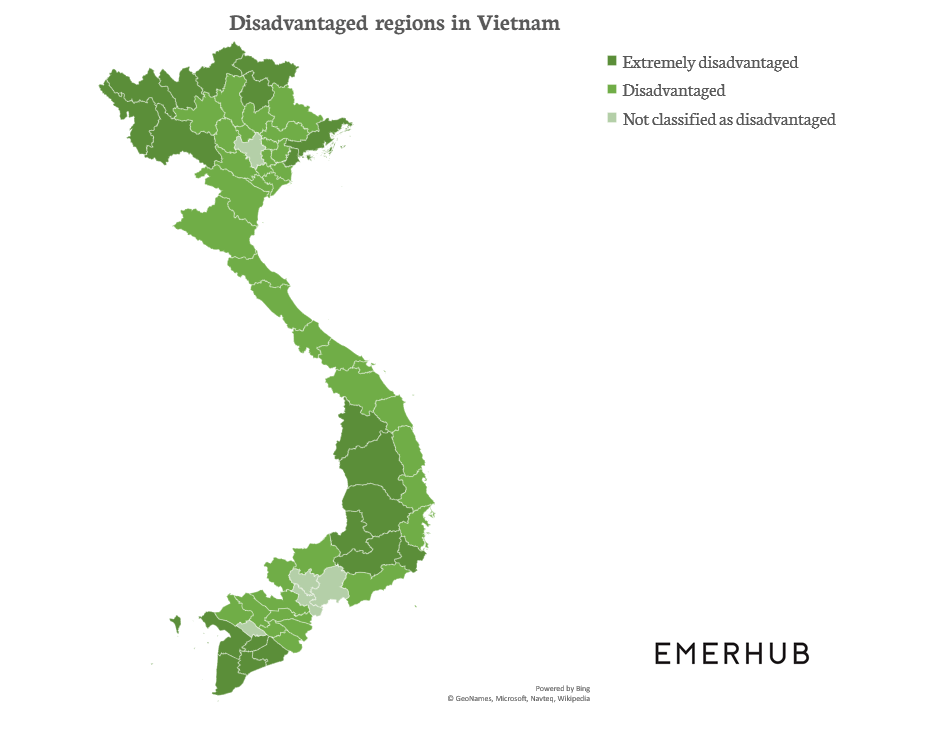

Tax incentives in Vietnam’s disadvantaged regions

As seen in tables above, Vietnam offers tax reduction and exemption for investors who invest in areas with bad socio-economic situations to encourage development in those regions.

For example, in areas which:

- have poor infrastructure

- experience labor force shortage

- are situated in remote rural areas

Depending on the level of development, these areas are classified as disadvantaged or extremely disadvantaged in Government’s Decree No 118/2015/ND-CP.

Naturally, doing business in these locations may be slightly more complicated than it is in more advanced regions. However, when planned right, they also offer opportunities for taking full advantage of these incentives.

If you want to learn more about investment opportunities in the disadvantaged regions of Vietnam, contact us via [email protected].

Tax incentives for prioritized industries in Vietnam

Vietnam also offers investment incentives for projects that engage in business lines that are highly encouraged by the government. These prioritized industries can broadly be divided into three categories:

- High-tech industries, such as information technology, electronics, mechanics

- Projects that improve social conditions in Vietnam, such as environmental protection, healthcare, infrastructure construction

- Large-scale and labor-intensive projects

How to apply for tax incentives in Vietnam

It pays to do some preparation in order to maximize the benefits of Vietnam’s tax incentives. Make sure that your company’s investment license is also compatible with Vietnam’s prerequisites for foreign investment incentives.

Our experienced consultants at Emerhub can help you determine whether your company’s activities could also fall under industries that can benefit from preferential tax rates or tax holidays in Vietnam.

We also offer various accounting and tax services in Vietnam, including:

- Monthly, quarterly, and yearly tax reporting and compliance

- Accounting and bookkeeping

- Payroll management

Book a consultation by filling in the form below or find more information on our company registration page. Let’s discuss how we can help you do business in Vietnam successfully.