Table of contents

Once you have completed the process of incorporation in the Philippines, it is crucial that you also keep your company’s records straight from the very beginning.

Paying taxes can be daunting in every country, not to mention emerging markets where requirements are different and demand a lot of paperwork. We have put together this guide to give you an overview of tax reporting in the Philippines.

2018 tax reform in the Philippines

In the Philippines, the national taxes are collected by the Bureau of Internal Revenue (BIR), an agency of the Department of Finance of the Republic of the Philippines.

So far, the tax system in the Philippines has been complex and time-consuming. However, president Duterte’s administration has prioritized to improve the country’s tax system for the better.

What is the Tax Reform Program in the Philippines?

The first package of the Tax Reform Program, Tax Reform for Acceleration and Inclusion (TRAIN), has already been signed and is effective since January 2018.

The main purpose of the TRAIN package is to provide a more fair tax system, direct more funds to sectors in need of improvement, and relieve the tax burden of the less fortunate, as explained by the Department of Finance.

Some of the changes resulting from the TRAIN package are, for example:

- Lower personal income tax rates

- Higher tax on sugar-sweetened beverages (SSB excise)

- Less value-added tax exemptions

The second package of the Tax Reform Program in the Philippines has also been sent to Congress.

Corporate taxes in the Philippines

Corporate income tax in the Philippines

Every corporation that is registered in the Philippines and engages in business in the country, both domestic and foreign, is subject to corporate income tax (CIT). The standard CIT rate imposed on the income of companies in the Philippines is 30%.

However, note that domestic corporations are subject to CIT on all income, including income generated from overseas, whereas foreign corporations are only taxed on the income that is derived from the Philippines.

Corporate income tax in the Philippines is declared and paid quarterly. The deadline for submitting annual corporate income tax reports for the preceding year is 15 April.

However, if the deadline has passed and you haven’t reported your taxes in the Philippines yet, contact us via [email protected].

Our accountants will gladly help you sort out your taxes in the Philippines to avoid unnecessary future expenses on penalties resulting from falsely reported taxes.

Want to maximize the benefits the country offers for foreign investors? Have a look at our previous article on tax incentives in the Philippines.

Value-added tax in the Philippines

Companies selling products or providing services in the Philippines are also subject to value-added tax (VAT). The standard VAT rate in the Philippines is 12% and certain products or services can even enjoy VAT exemption.

However, as the TRAIN program adjusted the Philippines’ VAT collecting system as well, the list of products and services eligible for VAT-exemption was reduced significantly.

For example, products and services still eligible for VAT-exemption are:

- Agricultural food products

- Educational services

- Health care services

VAT can be declared either monthly or quarterly in the Philippines. Monthly declarations must be submitted by the 20th day of the following month. When reporting VAT quarterly, however, the declaration must be submitted by the 25th day of the following month.

Employment taxes in the Philippines

When hiring employees in the Philippines, you also need to register your employees and pay the following taxes:

|

Type of tax |

Paid by the employer |

Deducted from the salary |

|

Social Security (SSS) |

9.5% |

4.5% |

|

Employees Compensation (EC) |

|

N/A |

|

Payroll tax |

1.16-1.19% |

N/A |

Source: SSS Guidebook 2017

Personal income tax in the Philippines

The Philippines executes a progressive personal income tax system. Starting from 2018, the PIT rates in the Philippines are as follows:

|

Annual taxable income |

PIT rate 2018-2022 |

PIT rate from 2023 |

|

PHP 0-250,000 (~US$ 0-4,775) |

0% |

0% |

|

PHP 250,000-400,000 (~US$ 4,775-7,640) |

20% on PHP 250,000-400,000 |

15% on PHP 250,000-400,000 |

|

PHP 400,000-800,000 (~US$ 7,640-15,280) |

PHP 30,000 on income up to PHP 400,000 + 25% on PHP 400,000-800,00 |

PHP 22,500 + 20% on PHP 400,000-800,000 |

|

PHP 800,000-2,000,000 (~US$ 15,280-38,000) |

PHP 130,000 on income up to PHP 800,000 + 30% on PHP 800,000-2 million |

PHP 102,500 + 25% on PHP 800,000-2 million |

|

PHP 2,000,000-8,000,000 (~US$ 38,000-152,000) |

PHP 490,000 on income up to PHP 2 million + 32% on the excess over PHP 8 million |

PHP 402,500 + 30% on PHP 2-8 million |

|

PHP 8,000,000 and more (~US$ 152,000 and more) |

PHP 2,410,000 on income up to 8 million + 35% on the excess over 8 million |

PHP 2,202,500 + 35% on 8+ million |

Source: Republic Act No. 10963 (TRAIN Law)

Who needs to declare personal income tax in the Philippines?

In general, every person whose income is derived from sources within the Philippines must submit their income tax reports.

Individuals who need to submit their income tax reports in the Philippines are:

- Filipino citizens residing in the Philippines

- Filipinos residing abroad on the income generated from the Philippines

- Foreign residents in the Philippines on income from sources within the Philippines

- Foreign non-residents who work, engage in business or trade in the Philippines

The deadline for submitting annual personal income tax reports in the Philippines is 15 April.

Keeping of books of accounts and records

All companies in the Philippines are also required to keep books of accounts on their expenses and earnings. Companies with quarterly transactions under PHP 50,000 (~US$ 960) can have a simplified book of records.

However, companies with transactions over PHP 150,000 (~US$ 2,870) need to have their books of accounts audited by independent and certified public accountants once a year.

How to report taxes in the Philippines?

Tax reporting is a time-consuming process, especially in emerging markets such as the Philippines where keeping compliance can even take hundreds of hours due to complex requirements.

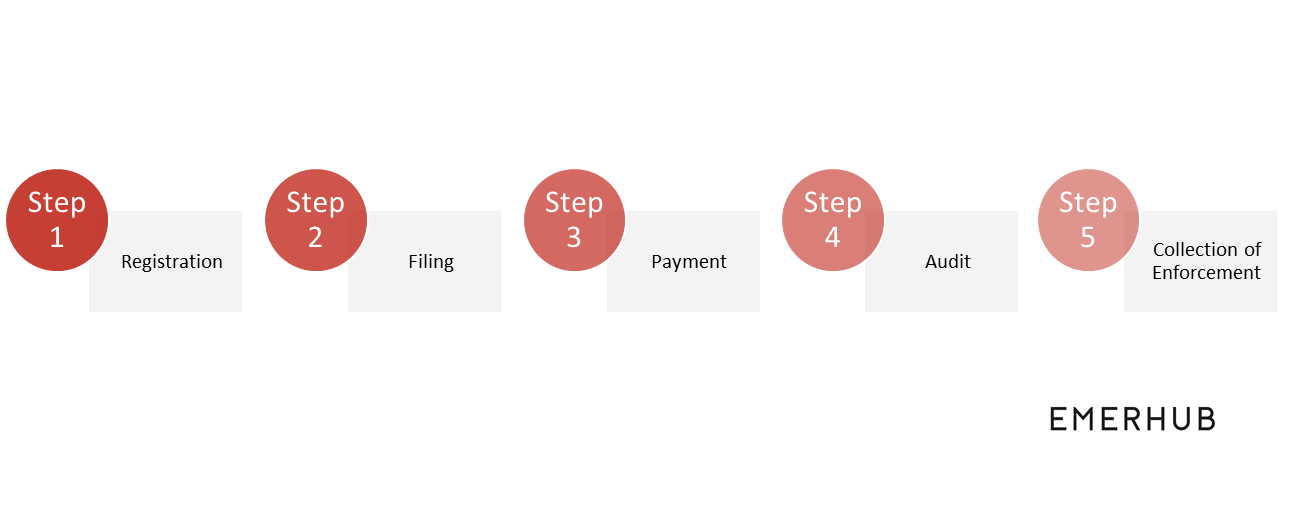

The process of reporting your taxes in the Philippines consists of five main steps:

As the Philippines’ tax system is also full of nuances, all cases cannot be summarized in one article. To ensure that your taxes are in compliance with the Philippines tax laws, it is wise to let professionals handle your tax reporting.

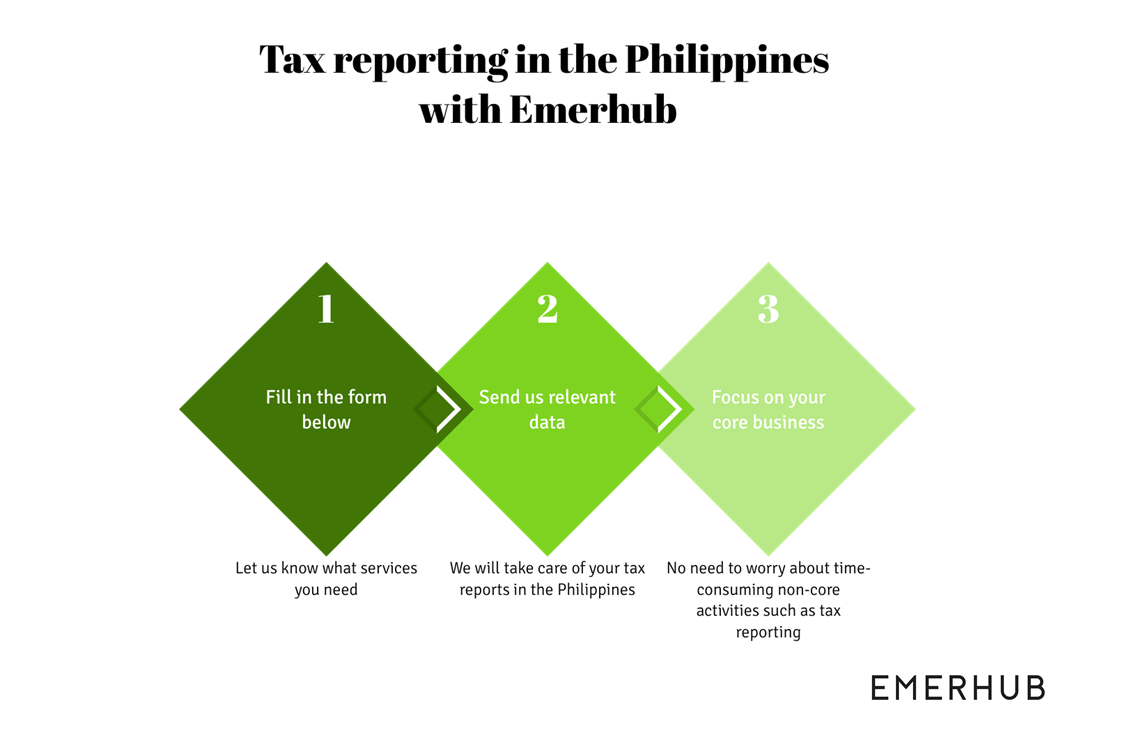

Outsourcing accounting services in the Philippines

Instead of wasting your valuable time on digging into Philippines’ compliance requirements or hiring an in-house accountant, the easier and more cost-effective option would be to outsource such non-core services.

Emerhub provides various accounting and tax services in the Philippines, including:

- Bookkeeping

- Monthly, quarterly, and yearly tax reporting

- Payroll management

Getting started with tax reporting in the Philippines

All you need to do is provide us with relevant information and our team of experienced accountants in the Philippines will take care of the rest. Start by simply filling in the form below.