Table of contents

Keeping your tax reports in compliance is a time-consuming yet crucial part of doing business, especially when operating in a foreign market.

For this reason, we have put together this article to highlight the key things a foreign investor needs to know about corporate compliance and tax reporting in Vietnam.

This article was last updated in January 2019.

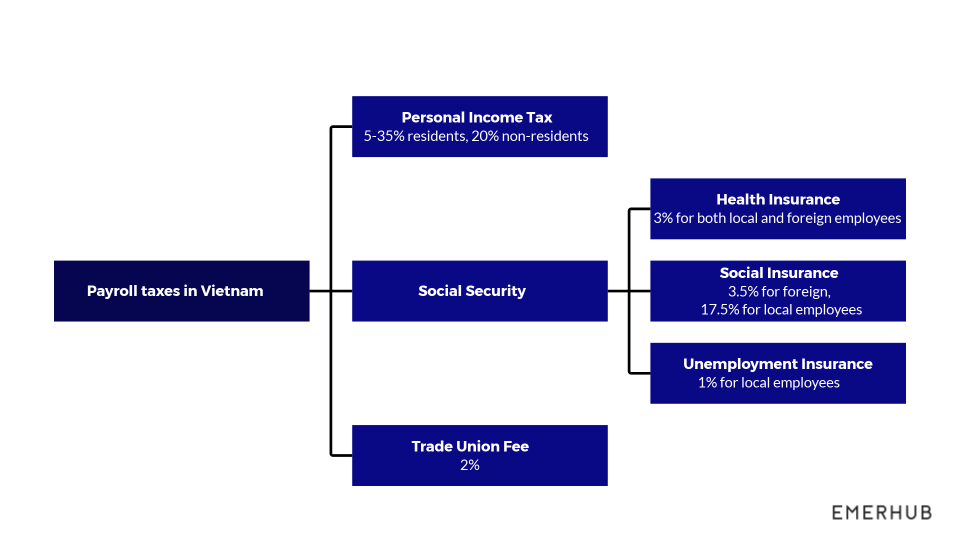

Employment taxes in Vietnam

In Vietnam, employers must pay the following taxes on each of their employee:

|

Type of tax |

Tax rate |

Due date |

|

Personal Income Tax (PIT) |

5-35%, 20% for non-residents |

Declared and paid quarterly* *If PIT exceeds VND 50 million in January or if VAT is paid monthly due to revenue, PIT is also paid monthly |

|

Social Insurance |

17.5% |

Monthly payment |

|

Health Insurance |

3% |

Monthly payment |

|

Unemployment Insurance |

1% |

Monthly payment |

|

Trade Union Fee |

2% |

Monthly payment |

So far, foreign employees have only received health insurance out of the three insurances. Consequently, the employment tax amount on foreign employees has been significantly lower than on local employees.

However, in 2014, Vietnam passed the Social Insurance Law according to which companies could also start making social insurance payments on their foreign employees beginning from January 2018, meaning that foreign employees would receive the same benefits as the Vietnamese employees do.

In October 2018, the government released the long-awaited Decree 143/2018/ND-CP which made social insurance payments compulsory also on foreign employees, starting from December 2018.

Read more about these critical changes in payroll management in Vietnam.

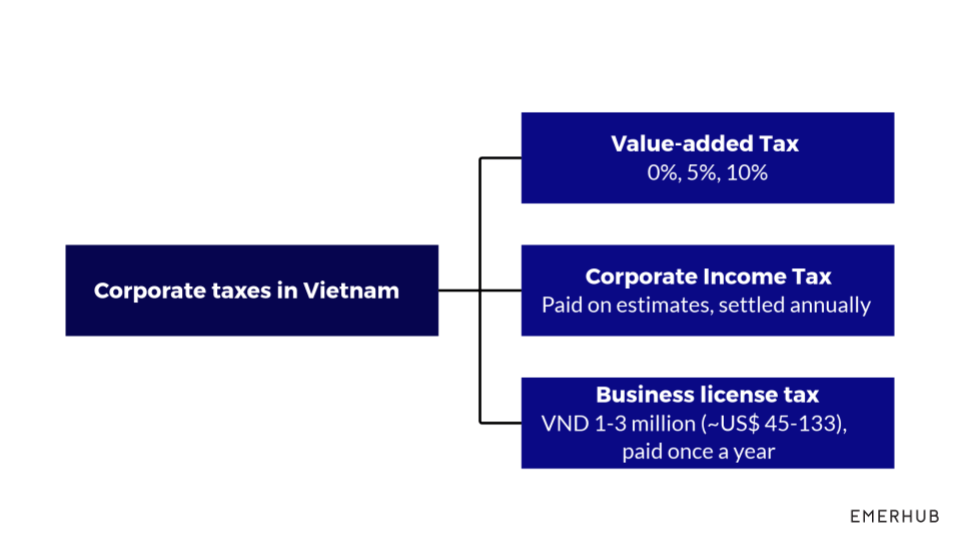

Corporate taxes in Vietnam

Corporate taxes are another segment of charges that companies in Vietnam need to keep in mind.

Companies in Vietnam need to submit the following declarations and pay the following corporate taxes:

|

Type of tax |

Tax rate |

Due date |

|

Value-added Tax (VAT) |

0%, 5% or 10%* *Depends on the type of goods and services |

Declared and paid quarterly* *If last year’s revenue exceeds VND 50 billion or if the PIT is declared monthly, VAT is also declared and paid monthly |

|

Corporate Income Tax (CIT) |

Paid on estimates, annual settlement declaration |

Paid quarterly, over- and underpayments settled annually |

|

Business License Tax |

VND 1-3 million* (~US$ 45-133) *Depends on registered charter capital and type of business |

Paid annually, deadline 30 January |

Make sure that you have also taken full advantage of the tax incentives in Vietnam when you register a company in Vietnam.

We have also further described a one-year cycle in the life of a foreign company in our previous article about corporate compliance in Vietnam.

Tax return in Vietnam

Tax refund for companies in Vietnam

Companies in Vietnam can get a tax refund on Value-added Tax (VAT) and Corporate Income Tax (CIT):

|

Type of tax |

Deadline of declaration |

|

Value-added Tax |

Declared and refunded once you reach the cumulative amount of VND 300 million (~US$ 13,000) |

|

Corporate Income Tax |

Declared at the end of Q1, reimbursed annually |

Tax refund for individuals in Vietnam

Individuals in Vietnam are also eligible for tax refunds on Personal Income Tax (PIT). The deadline for submitting the PIT settlement declaration is the end of the first quarter.

If the PIT payment was higher than necessary, it is also possible to submit your declaration after the end of Q1.

Who can claim tax refunds in Vietnam?

If a person is a resident in Vietnam, the PIT and other employment taxes must be paid and declared in Vietnam as well.

A tax resident is anyone who, either:

- Lives in Vietnam for 183 days or more in a total of 12 months since the date of arrival

- Holds a temporary/permanent resident card

- Has an address registered with the police for 183 days or longer

If the person receives a salary for working for a company abroad and employment taxes are paid elsewhere, but the individual is still a resident in Vietnam, the employment taxes should be paid in Vietnam as well.

How to report taxes in Vietnam?

The essential compliance deadlines to keep in mind at the beginning of the year are 30 January and 1 April.

The fine for non-timely reports starts from VND 700,000 (~US$ 30) and can go up to VND 25 million (~US$ 1,100) and is based on overdue days. Furthermore, the government bodies can even annul your operating licenses, should you ignore the fines and reporting claims.

Therefore, it is strongly advised to keep your records straight and improve your further tax planning or use a tax consultant in Vietnam to avoid unnecessary expenses in the future,

Also, bear in mind that the Vietnamese Accounting Standards (VAS) differ slightly from the International Financial Reporting Standards (IFRS). For that reason, you cannot directly use global accounting software.

Not sure whether you have reported your taxes in Vietnam properly?

Get in touch with Emerhub to make sure you have fulfilled your tax reporting and compliance requirements in Vietnam.

Our team of experienced accountants will help you keep your records straight.

Our accounting services in Vietnam include:

- Accounting and bookkeeping

- Tax reporting and compliance

- Payroll management

Fill in the form below to get started.