Table of contents

What is the minimum capital requirement in Pakistan? How much money do you need to pay up to incorporate the foreign company?

Types of Capital in Pakistan

There are two types of share capital in Pakistan, the paid up capital and the authorized capital.

Paid up Capital

Paid up capital is the amount of money the shareholders contribute to the company. It can be in the form of cash or assets given in exchange for stocks within the company.

Authorized Capital

On the other hand, authorized capital is the maximum contribution of capital to the company as authorized by the company’s Articles of Association.

Minimum Capital Requirement in Pakistan

As stated in the Companies Act, 2017, there is no minimum capital requirement for foreign-owned companies in Pakistan. However, companies should subscribe at least PKR 100,000 ($800) as capital to incorporate the company.

On the other hand, the public limited companies have a minimum capital requirement of PKR 200 million ($1.6 million). The company should comprise of at least seven shareholders to start the business operations.

Also, note that the paid-up capital and authorized capital of the company can be whatever the shareholders decide and are sufficient to start the operations.

Common questions about the capital requirement

Are there any differences in capital requirements per industry?

There is no minimum capital requirement in Pakistan irrespective of the industry, even for capital-intensive fields such as manufacturing. The capital has to be enough to sustain the operations of the business.

Can the capital be in other forms?

After injecting the capital, it will be considered as the capital of the company. Any contribution such as machinery or any other assets can be recognized as capital for the company. It is now the capital as long as it has value to the company.

When to inject the capital contribution?

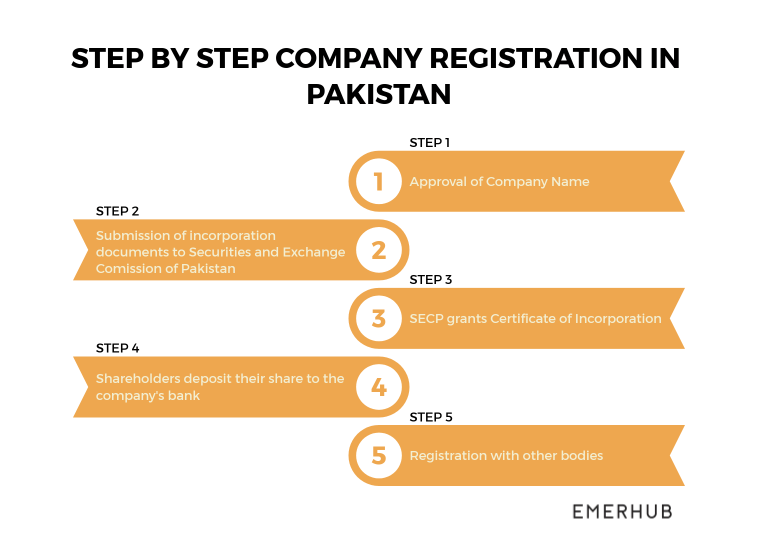

The process of company registration in Pakistan starts with the approval of the company name. Note that once your company name is approved, it will be reserved for 90 days.

Secondly, during the 90 days, you need to submit your incorporation documents to the Securities and Exchange Commission of Pakistan (SECP). Once you provided all the necessary incorporation documents, SECP will grant you your Certificate of Incorporation.

After the registration, the shareholders of the company will have to deposit their capital investment into the company’s respective bank account.

The company also needs to undergo registrations with other bodies such as the Federal Board of Revenue and acquire a National Tax Number (NTN) and Sales Tax Registration Number.

You can also check our article about company registration in Pakistan to know more about company set up in Pakistan.

Can I use the injected capital for working capital later on?

After you inject the capital into the company, you can now use it for any business-related purpose.

If you’re planning to start your business in Pakistan, don’t hesitate to contact us by filling out the form below. Our consultants will be happy to help you!