Table of contents

In this article, we will give you an overview of the requirements and the step-by-step process of setting up an import company in Pakistan.

Also, learn why you should acquire an import license despite it not being a mandatory requirement by the law.

Requirements for setting up an import company in Pakistan

Who can import to Pakistan?

Foreign investors can set up 100% foreign-owned import companies in Pakistan. Any company, partnership, or individual can import to Pakistan as long as they fulfill the general requirements:

- Obtain a National Tax Number (NTN) issued by Federal Board of Revenue (FBR)

- Obtain a Sales Tax Registration Number (STRN) from FBR

- Have a bank account in Pakistan

- Are a member of any chamber of the Chamber of Commerce and Industries (CCI)

Import license in Pakistan

Take note that having an import license is not mandatory in Pakistan. It means that anyone who fulfills the said requirements can start importing to Pakistan.

However, as the requirements mentioned above are also the prerequisites for obtaining an import license, it is recommended to take the additional step and acquire an import license when planning on importing to Pakistan.

Having an import license will make the import process smoother and faster. Not having an import license, on the other hand, may result in unnecessary delays and additional costs. Especially if you want to import products that have more restrictions.

To get an import license in Pakistan, you need to send the proof of the fulfillment of these requirements to the Federal Board of Revenue (FBR). Emerhub will assist you with meeting these requirements for the import license and make the necessary arrangements on your behalf.

In general, it takes one month to receive an import license in Pakistan.

Minimum capital requirement

The Companies Act 2017 does not state any minimum capital requirement for setting up a company in Pakistan. For this reason, PKR 100,000 (~800 USD) is considered the minimum capital requirement in Pakistan.

However, take note that this amount is just a standard figure for setting up any company in Pakistan. And the actual capital allotted for the set up will depend on the planned expenses of your company.

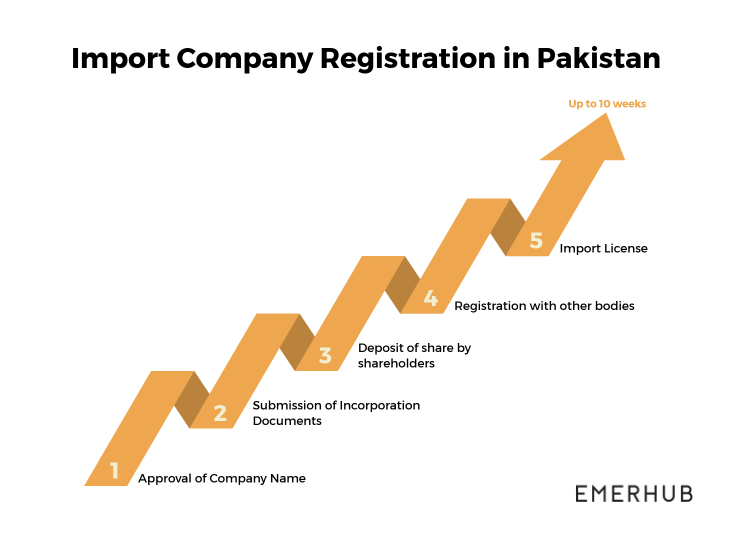

The step-by-step process of setting up an import company in Pakistan

Securities and Exchange Commission of Pakistan (SECP) is the regulating body for company incorporation in Pakistan. Apart from applying for an import license, the general procedure for setting up an import company is the same as for any other company registration in Pakistan.

#1 Company name approval

Approval of the company’s name is the first step of company registration in Pakistan.

Once approved, you need to submit all your incorporation documents within 90 days.

#2 Submission of incorporation documents

The second step of your company registration is the submission of the incorporation documents. Listed below are the necessary documents you need to be submitted:

- Three copies of Memorandum of Association (MOA) approved by all shareholders

- Three copies of Articles of Association (AOA) signed by all shareholders

- Copies of Computerized National Identity Card/National Identity Card for Overseas Pakistani of the subscribers/directors/chief executive officer/nominee (for single member company)/authorized representative or copies of Passport in case of a foreigner

- Authorization for Filing of Documents by the subscribers

- Registration/Filing Fee (depends on the capital)

- No Objection Certificate/Letter of Intent/License (if any) of the relevant regulatory authority in case of specialized business.

- Declarations on Prescribed Forms

Once you submit all the incorporation documents, you will receive a Certificate of Incorporation from the Security and Exchange Commission of Pakistan (SECP).

#3 Deposit of shares by shareholders

After the registration process, shareholders of the company will have to deposit their share to the bank account of the company. After the capital injection, the company can now start its operation.

#4 Additional registration

Furthermore, your import company also needs to register with the Federal Board of Revenue (FBR). It is necessary as a National Tax Number and Sales Tax Registration Number are both primary requirements.

#5 Import license

The last step of registering an import company in Pakistan is to apply for an import license. For that, you need to fulfill the general requirements and submit documents to the Federal Board of Revenue (FBR).

In general, it takes one month to acquire an import license in Pakistan.

Import to Pakistan using an importer of record

If you wish to start importing to Pakistan sooner or don’t want to set up an import company, you can also use an importer of record (IOR) service.

Using an IOR service provider, such as Emerhub, allows you to import products to Pakistan without acquiring any licenses or incorporating a company.

Another benefit of using an importer of record service is that it will let you focus on your core business as a legal entity will do the work for you.

For learning more about how you can import to Pakistan immediately, have a look at our article about the benefits of the importer of record in Southeast Asia.

Getting started with setting up an import company in Pakistan

Do not hesitate to reach out to us by filling out the form below to begin your import company registration in Pakistan or for any further questions. Our consultants will be happy to help you!