Table of contents

Emerging markets offer great business opportunities. However, there will always be unknown variables that can become turning points for your business. How to be better prepared for these occasions? In this article, we talk about the importance of due diligence in emerging markets.

What is due diligence

Due diligence is the process of investigating your business opportunity before making a decision. You verify the accuracy of the given information and evaluate whether it is a good business deal or not.

Simply put, due diligence means doing your homework before signing a business agreement. It consists of collecting and reviewing all the relevant information regarding your future business.

Importance of due diligence in emerging markets

Due diligence allows you to stay ahead of your competitors and make strategic decisions. The scope of due diligence should be much greater in emerging markets than in developed markets. This is due to many factors that are not that evident in advanced markets such as quickly changing regulations or bureaucracy and corruption.

However, this does not mean that it is impossible to do business in emerging markets. It only emphasizes the importance of a thorough research before doing so. As A.G. Bell has said: ‘Before anything else, preparation is the key to success’. In the business sphere, this especially applies when entering emerging markets.

Why outsourcing due diligence may be more efficient

One option is to do your own research based on the limited public information. However, in markets such as Indonesia, Vietnam or the Philippines, the information found in public database is often limited.

Outsourcing enables you access to confidential information that is not listed in the public database. For example, when doing your own research you may later discover that the company you purchased does not even have all the necessary operating licenses.

The more in-depth your analysis is, the fewer risks you will take. Even salt looks like sugar and some of the deals that may seem highly profitable at first can turn out to be terrible investments in the future. Often because of insufficient homework that was done prior to the investment.

Types of due diligence

Buying a business or a property

When purchasing a company or a property, you should always perform due diligence to verify that your object of interest has all the necessary documentation in order and all the compliance requirements are met. Your investment can quickly go down the drain if you discover these realities only after signing the papers.

For example, if you want to buy and rent out a villa in Bali, make sure that it has a building permit (IMB). Many people discover too late that their purchased property does not have the required documentation. This is a mistake that you could easily avoid by conducting proper due diligence before making the purchase.

Finding vendors

You have found a vendor who seemingly meets all your expectations. However, before agreeing to cooperate with a new supplier, it is wise to learn all the facts about your future business partner. Conducting due diligence reduces the probability of scam.

Here is how you can find the best vendors in Indonesia, Vietnam or in the Philippines.

Hiring new employees

Due diligence is an essential part of the process of looking for new employees as well, especially for senior roles. It is as an important business decision as any other and choosing the wrong person to fill the position can be quite costly for you in the long run.

Thus, doing some research in addition to the interview with the applicant leads you to making the best decisions for your company. Emerhub can assist you with the recruitment process in Indonesia, Bali, Vietnam, and the Philippines.

Expanding your operations to a new market

Conducting due diligence and obtaining knowledge about the market you are about to enter gives you the intelligence to make better decisions in the future and therefore reduces your risks significantly.

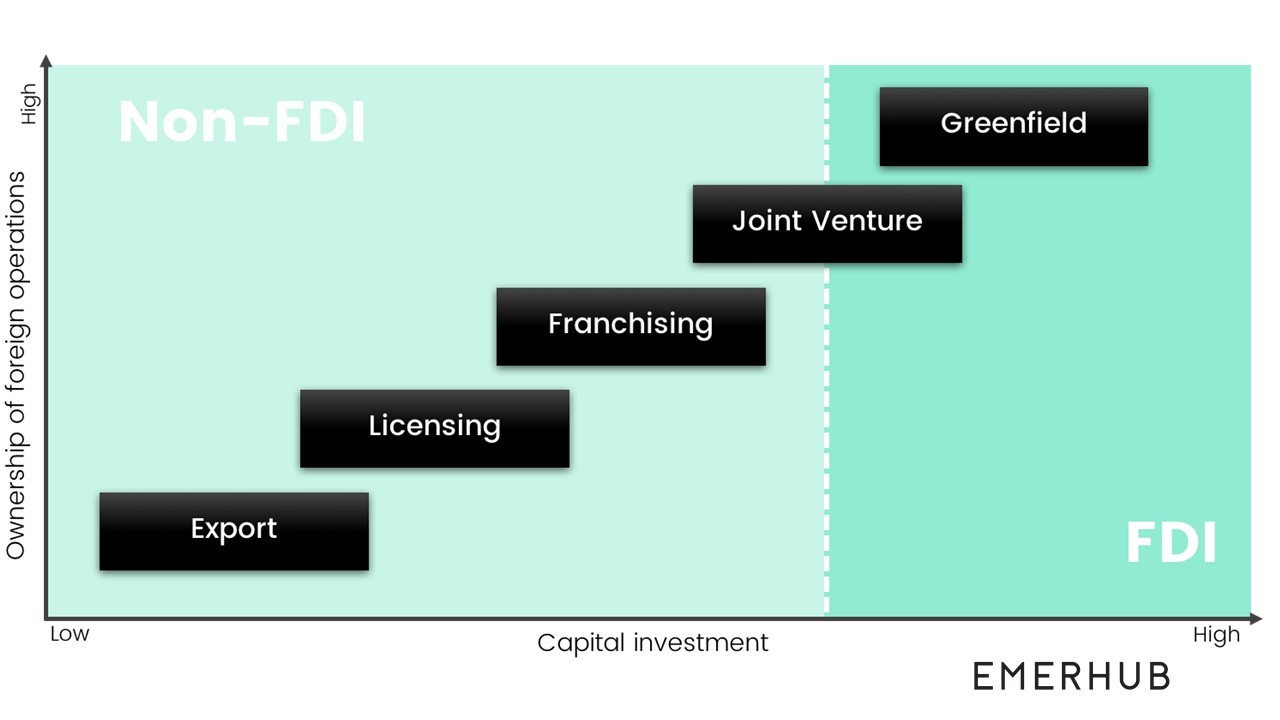

Choosing the right market entry strategy also plays an important role when expanding your business. See foreign direct investment options in the graph below. To learn more about different types of market entry strategies, read our previous article.

Main benefits of outsourcing due diligence

#1 Reduces the risk of bad surprises

Conducting due diligence in-house requires the person behind it to be experienced in finance, law, and to have great investigation skills for doing a background check. Since conducting proper due diligence can be considered as the groundsill of doing successful business, mistakes can be expensive.

Due diligence reduces the risk of bad surprises significantly. For instance, you won’t discover that some important part of information was misinterpreted or left unnoticed.

#2 Conducted by someone who knows the local market

Even if there are sufficient professional skills such as experience in general finance and law, the person or team behind due diligence should also be familiar with the local market. This is especially the case in emerging markets where laws can include nuances that may be ambiguous or change frequently.

#3 Saves your time and money

Doing due diligence in-house can be quite time-consuming. And also costly, if mistakes occur or the research is not done thoroughly enough, causing unpleasant disappointments in the future.

Due diligence does not belong among your core activities, thus you can outsource it instead. By doing so, you will save both time and money. You can use all this saved time on much more important tasks, such as growing your business or developing your strategies.

#4 Gives you peace of mind

By outsourcing due diligence you will be provided with a thorough analysis of all the information that is relevant to your current business transaction. You don’t have to worry about losing some important information or forgetting to check some aspects.

To learn more about some of the recommended due diligence activities see the table below.

Due diligence activities Emerhub offers

Here’s a list of some of the main due diligence activities Emerhub can conduct for you:

|

We will determine: |

| 1. The business classification of the company |

| 2. Whether the company has acquired all the relevant licenses |

| 3. Whether the company has reported tax and investment correctly |

| 4. Number of employees |

| 5. Registered address |

|

We also conduct: |

| 6. Competitive analysis |

| 7. Market analysis |

Due diligence in Indonesia

Drop us an email at [email protected] and we will get back to you shortly to discuss the necessary due diligence before buying or starting a company in Indonesia.

Due diligence in Bali

Contact our Bali office to learn more about what sort of due diligence activities you should conduct specifically in Bali via [email protected].

Due diligence in Vietnam

Get in touch with our Saigon office via [email protected] for a consultation on due diligence in Vietnam.

Due diligence in the Philippines

Leave your details in the form below or send us an email at [email protected] to find out more about due diligence in the Philippines.