Table of contents

In order to run a sustainable business in Vietnam, all companies and representative offices need to keep to compliance deadlines in Vietnam. This includes the submission of periodic reports. If you don’t provide these completed reports on time you could incur easily avoidable fines.

In some cases, the Vietnamese authorities will notify you when your reporting is late or not up to scratch. However, it’s fairly common to receive no notifications. You could still be surprised with fines if the Vietnam authorities decide to carry out random checks on past and present reporting on your LLC or rep. office.

Here are the key accounting and compliance deadlines that every owner of an LLC or representative office in Vietnam should be aware of.

Reporting Requirements for LLC’s in Vietnam

If you have a registered LLC in Vietnam, you will need to submit the following reports

- Business licence tax

- Report on Employment and Labour

- Statistic Report

- FDI Report

- Tax Settlement

- Financial Statement

- Internal Policy Registration

Vietnam’s compliance calendar for the first quarter of 2022

In Vietnam, you can choose from four fiscal year periods if you run a foreign entity:

- January 1 to December 31

- April 1 to March 31

- July 1 to June 30

- October 1 to September 30

There are several deadlines distributed over the year, however, the most important compliance deadlines in Vietnam fall on the first quarter:

If you don’t choose a specific fiscal year period, you are assumed to be in January 1 to December 31. The rest of this blog is based on this period.

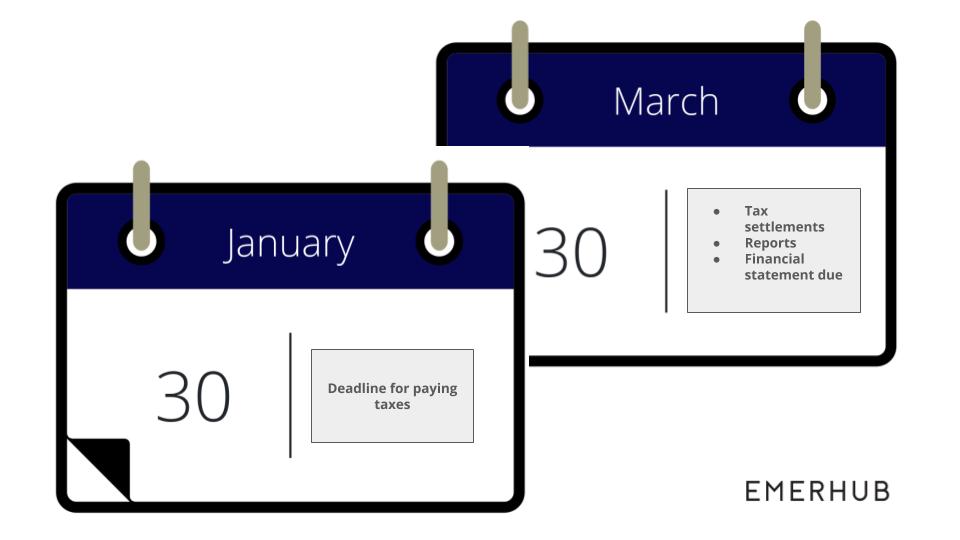

Deadline for paying taxes – January 30

As quarterly compliance in Vietnam requires you to pay taxes for the previous quarter by the 30th day of the following quarter, the year begins with tax declarations and payments.

|

Type of tax |

Declaration and payment deadline |

How to report |

|

Corporate Income Tax (CIT) for Q4 of 2022 |

No declaration paid on estimates Due: January 30, 2023 |

Report to your local tax department using HTKK software |

|

Personal Income Tax (PIT) for Q4 of 2022 |

Declaration and payment due: January 30, 2023 |

|

|

Value-Added Tax (VAT) for Q4 of 2022 |

Declaration and payment due: January 30, 2023 |

Annual business license tax payment

Vietnam’s government introduced Decree 22/2022/ND-CP exempting Business License Tax for newly established businesses in the first year. And the deadline for BLT is no later than January 30 of the year.

Late or non-payment of the Business Licence Tax can result in fines of up to $1041. However, the biggest risk is getting your tax code blocked. The cost and time needed to unblock your tax code will outweigh the cost of the fine.

The amount of the business license tax you need to pay depends on your registered charter capital and the type of your business:

|

Charter capital/type of your business |

Business license tax |

|

Capital is 10 billion VND or less (~US$ 430,000) |

2 million VND (~US$ 85) |

|

Capital is more than 10 billion VND |

3 million VND (~US$ 130) |

|

Branches, representative offices, business location, public service providers, and other business organizations |

1 million VND (~US$ 40) |

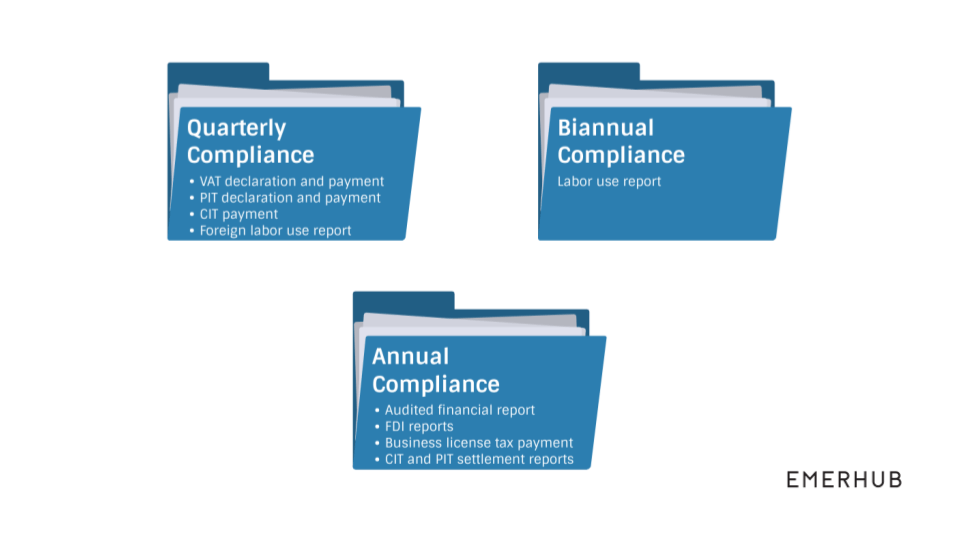

Corporate compliance in Vietnam throughout the year

As shown mentioned above, most of the chief compliance deadlines in Vietnam are in Q1. However, there are also other important quarterly, annual, and biannual compliance requirements that you need to know.

To find more information on what are the compliance requirements after incorporation and throughout the year, read our in-depth article on corporate compliance in Vietnam or book a free consultation with our accounting team directly via [email protected].

Deadline for reports – March 30

The next significant compliance deadline in Vietnam that you as a business owner need to keep in mind is March 30 by which you must submit the majority of the reports required in Vietnam.

Financial statement in Vietnam

By March 30, 2023, companies in Vietnam also need to file their annual financial report for 2022 which has to include:

- Balance sheet

- Profit and loss

- Cash flow

- Note of financial statement

If you registered your company before October 2022, you are required to submit a financial statement for 2022. If later, you can consolidate your financial report for 2022 together with the next year’s report.

The accounting records must be kept in the currency of Vietnamese dong and written in Vietnamese. In case you have a foreign-owned company, you must also have your financial report audited by an independent Vietnamese auditing company.

Emerhub’s team of knowledgeable accountants can help you with your financial statement in Vietnam as well as have it audited and submitted it to respective institutions on your behalf. Contact us via [email protected] to get started.

Tax settlement declarations for 2022

The end of Q1 is also the time to file the settlement reports for your previous year’s taxes:

- CIT settlement declaration for 2022

- PIT settlement declaration for 2022

Note that if the total PIT and CIT tax amounts that you paid quarterly in 2022 are smaller than the total tax amount in the settlement, your company must also pay the difference.

Did you know? You can reduce your corporate income tax in Vietnam by claiming VAT invoices as expenses. In fact, not asking for a VAT invoice while making a purchase is one of the seven common mistakes companies make in Vietnam.

Statistics report

Foreign-owned companies or companies with any foreign investments must submit a Statistics Report to either the Department of Planning and Investment or Department of Statistics or both. The submission frequency can be monthly, quarterly or annually depending on your company’s industry.

This report gives the Vietnamese authorities an overall picture of your company’s business activities during the given period. A late or missing submission can result in a fine ranging from $42 to $840 and will pose a challenge to the company’s business licence renewal.

FDI reports

If your company has investment coming from another country, you also need to submit reports on the progress of every foreign-invested project. These reports must give an overview of the profits, losses, revenue, and expenses met during the previous year.

Reporting Requirements for LLC’s and Representative Offices

Regardless of whether you have an LLC or a representative office in Vietnam, you will need to submit the following:

- Report on Employment and Labor

- Internal Policy Registration

- Personal Income Tax Year-End Finalization

Company Reporting on Employment and Labor

The Employment and Labour Report should be submitted to the Department of Labour twice a year, once on the 25th of May and a second time on the 25th of November.

If your company employs foreigners, it has to submit a report specifically on foreign employment every quarter. Late submission or the absence of these reports will result in a fine of up to $840 on each occasion. The greater risk lies in the challenges you could face in the future when submitting Work Permit applications, renewals or extensions. In addition, you risk compromising the on-going sponsorship of your company in Vietnam.

Company reporting on Internal Policy Registration

As soon as your company starts hiring employees, you must establish an internal policy for the regulation of employer-employee relationships within the company. This policy needs to be registered with the Department of Labour. Whenever there is a change in employment law in Vietnam, this policy needs to be updated and re-submitted for approval.

This policy will be used to mediate and solve conflicts arising within the company. In the case of a dispute or a lawsuit, this policy will be used by the court or the relevant government authority to settle the case.

Reporting Requirements for Representative Offices Only

Representative offices are liable for significantly less than an LLC. However, you still need to ensure that the following reports are submitted according to compliance deadlines in Vietnam to avoid costly fines. Particularly if the company running your representative office takes a more hands-off approach.

Here is a list of the reports you need to submit as a representative office. The first two have already been described above.

- Report on Employment and Labor

- Internal Policy Registration

- Operations report

- Renewal of Representative Office Licence

PIT year-end finalization

Rep. Offices need to report the Personal Income Tax (PIT) of all its employees. The PIT reports should be filed every month or quarter (depending on the company’s reporting cycle).

On March 30th, which is the end of the fiscal year, your Rep. Office needs to submit a Personal Income Tax Year-end Finalization Report to the Vietnam Tax department.

Operations report

All Rep. offices need to submit an Operations report once a year to the Department of Industry and Trade (DOIT) by the 30th of January.

This report summarizes the major activities of the rep office during the year including employment status, business facilitation and other non-commercial activities.

The Operations report needs to be written to a template and follow specific standards. It is usually submitted in hardcopy format, in-person to the Department of Industry and Trade.

Failure to submit this report on-time will result in a fine between $1000 to $2000 depending on how late or report is, as well as difficulties in renewal of the representative office licence. Which brings us to:

Renewal of Representative Office Licence

A Representative Office Licence is usually valid for five years and needs to be renewed upon expiration. Failing to renew this licence on time can incur fines that increase as time passes.

Emerhub is well-versed in dealing with these cases and can negotiate long-running fines to more affordable sums.

What happens if you don’t meet compliance deadlines in Vietnam

Failure to meet the given deadlines will result in a fine. The amount of the fine you will face depends on the number of days you are late with your submission.

For a non-timely financial statement in Vietnam, for example, the fine starts from VND 700,000 (US$ 30) and can go up to VND 25,000,000 (~US$ 1,100).

In case of more serious breaches such as non-payment of fines or not taking notice of reporting claims, the government bodies have the authority to annul your company’s licenses and stop your operations.

The New Penal Code in Vietnam

Vietnam implemented the New Penal Code in January 2018, under which corporations can be now held criminally responsible for numerous violations, including tax evasion.

Therefore, it is of utmost importance to have your accounting paperwork and reports up to standard and submitted according to compliance deadlines in Vietnam.

…We at Emerhub believe that your main task should not be to navigate the ever-changing regulations and requirements in Vietnam, but to focus on building your core business instead.

Our team of experienced accountants will gladly assist you in meeting the compliance deadlines in Vietnam so that you would have more to concentrate on what you do best.

Our accounting and tax services in Vietnam include:

- Accounting and bookkeeping

- Tax reporting and compliance

- Payroll management

Get in touch with us via the form below for a complimentary consultation to discuss how we can assist you in keeping your company’s paperwork in order.