Table of contents

There are many reasons why Bangladesh is becoming one of the most promising emerging markets in the world. Some of the top reasons include its openness to foreign investment, competitive labor costs, and rapid economic growth.

Before investing, it is essential to know what legal entities are available to foreign investors. In this article, you will find an easy guide to company registration in Bangladesh.

Overview of legal entities in Bangladesh

|

Type of Entity |

Maximum allowed foreign ownership | Minimum paid-up capital | Minimum no. of shareholders |

|

Private Limited Company |

100% |

$1* | 2 |

|

Public Limited Company |

100% |

$1* |

7 |

|

Subsidiary Company |

51%-100% |

$1* |

2 |

|

Branch Office |

100% |

No capital* | No shareholders |

| Representative Office |

100% |

No capital* |

No shareholders |

*However, if you want to hire a foreign employee, you need to make an inward remittance of US$ 50,000 beforehand.

Requirements for company registration in Bangladesh

Allowed foreign ownership

Bangladesh is very open regarding foreign ownership, allowing up to 100% of foreign ownership in most sectors. In some sectors, however, you need prior approval from the government and a few sectors restrict both local and foreign investment.

Similarly, other benefits include the right to purchase land and property in the name of the company, tax incentives, etc.

Minimum capital requirement

There is no official minimum capital requirement in Bangladesh. For this reason, $1 is considered the minimum capital contribution. However, investors should keep in mind that they need to make an inward remittance of no less than $50,000 if they intend to hire foreign employees.

Types of legal entities available in Bangladesh

#1 Private Limited Company

A large number of companies in Bangladesh are registered as private limited companies (LLC). The liability is limited to shareholders’ shared capital and LLCs in Bangladesh can be fully foreign-owned.

Any person who is above 18 is eligible to register a company. Furthermore, the law prescribes a minimum of two and a maximum of 50 shareholders, and two directors. Also, note that you can form a joint venture with a local entity to share the strengths and lessen the risks.

#2 Public Limited Company

In contrast, a public limited company can invite the public to hold shares and is usually registered on a stock exchange.

A public limited company has a minimum of seven members, three directors, with no maximum number of shareholders. Its shareholders can be any legal person or any individual who is above the age of 18, qualified by Bangladesh Law.

It can raise funds from the public. Aside from Companies Act 1994, it should also comply with Securities and Exchange Commission Act 1993.

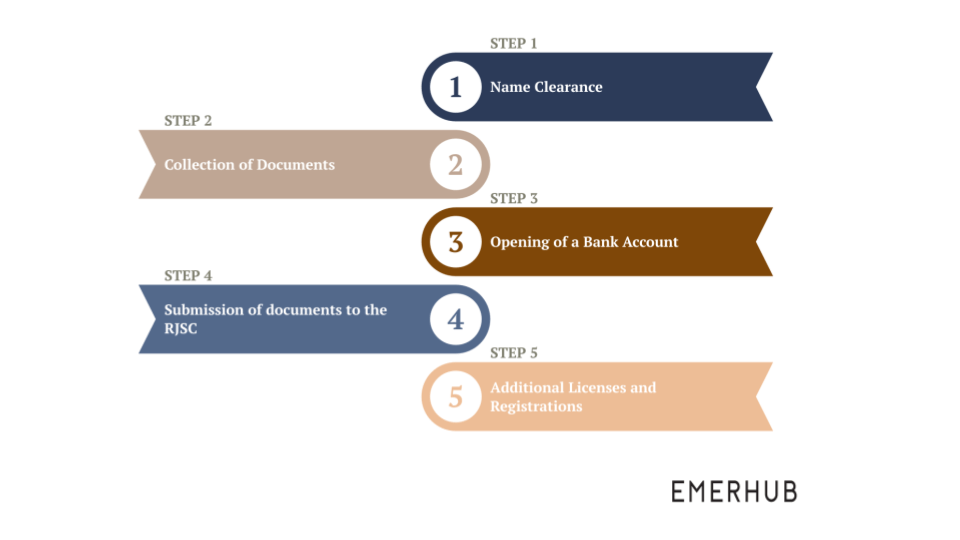

The step-by-step process of company registration in Bangladesh

The average estimated timeline of full registration in Bangladesh is 45- 60 days.

Step 1: Name clearance

Firstly, you need approval for your company’s name from The Registrar of Joint Stock Companies and Firms (RJSC).

Step 2: Drafting of required documents

Secondly, you need to draft the Article of Association (AoA) and Memorandum of Association (MoA). While preparing those, you need to draft it along with other forms as requirements for compliance to RSJC.

Step 3: Opening of bank account

Thirdly, you must open a bank account in the proposed name of the company and make an inward remittance of at least US$ 50,000 if you plan on hiring foreign employees. Emerhub can assist you with setting up the bank account.

Step 4: Submission of documents to the RSJC

In this step, you have to submit all the required papers to the RJSC and pay the registration fees. You can also look into RSJC for the incorporation certificate during the standard process time.

Step 5: Post-registration compliance

By this time, you have the certificate of incorporation, Articles of Association (AoA) and Memorandum of Association (MoA), and you have a newly registered company in Bangladesh.

You also need to proceed to some additional licenses and registrations:

- Trade License

- Tax Identification Number (TIN)

- VAT Registration Certificate

- Fire Certificate

- Environmental Clearance Certificate (if necessary)

Alternatives to setting up a company in Bangladesh

Branch

A branch is an extension of its parent company and not a separately incorporated entity. In other words, the parent company is responsible for its branch’s liabilities.

A branch can engage in commercial activities, given BIDA’s approval. However, the Exchange Control Guidelines monitors its operations strictly.

The average establishment time of a branch in Bangladesh is 45- 60 days.

Representative/ Liaison office

Just like a branch, a liaison, also called a representative office, is subject to BIDA’s approval as its primary requirement. It must have a parent company abroad, and its activities are limited since it only serves as a communication or coordination instrument of the business resources in Bangladesh.

Also, take note that a liaison office cannot earn any local income in Bangladesh. The parent company shoulders all of its expenses and operational costs through remittance.

There also cannot be any outward remittances of any kind from Bangladesh resources, except the amount brought in from abroad. Similarly, it also follows the general process of business registration in Bangladesh.

Franchise operation with local promoters

Foreign-owned companies can also enter into franchises in Bangladesh. Through a franchise, you can permit local promoters to use your brand, provide them with technical support and charge fees or commission on their activity.

A franchise operation complies with both the purchase and license agreement.

Are you planning to register a company in Bangladesh?

Get in touch with Emerhub by filling in the form below. Our consultants will be glad to assist you with company registration in Bangladesh.