Table of contents

Article updated in February 2023

Tourism in the Philippines is thriving, thereby creating a rising demand for hospitality businesses. This article will guide you through the process of setting up a guesthouse, resort, or hotel in the Philippines.

Tourism in the Philippines

The Department of Tourism (DOT) is set to embark on an aggressive campaign to promote the Philippines as a tourist destination and boost foreign investors’ interest in the Philippine experience. The total amount allotted for this purpose is PHP 6.39 billion under the FY 2023 National Budget.

Requirements for opening a guesthouse, resort, or hotel in the Philippines

The minimum capital requirement in the Philippines

The general minimum capital requirement for establishing a foreign company in the Philippines is US$200,000. However, depending on your business activities and the percentage of foreign equity, this requirement can also be higher or lower.

For example, retail trade companies with foreign equity need US$ 2.5 million of minimum paid-up capital. Also, you might need to invest a lot more in some hospitality businesses, such as resorts.

As an alternative to a foreign company, you can also set up a local company that can be established with a significantly lower capital requirement. In the Philippines, a company is considered locally owned when at least 60% of the shares are held by locals.

This advantageous opportunity drives many investors to turn to nominee shareholders when choosing their market entry strategy. However, make sure that the agreements between you and the nominee shareholder are revised by legal advisors. Emerhub can assist you with these contracts.

Read more about the minimum capital requirement in the Philippines.

Foreign ownership of housing businesses in the Philippines

The government understands the importance of foreign direct investment (FDI) in the Philippines and therefore, allows foreign investors to set up 100% foreign-owned companies in the Philippines, including businesses in the hospitality industry.

Some industries, however, are reserved for Filipinos, and foreign ownership is limited by the Foreign Investment Negative List.

How to set up a hotel in the Philippines

#1 Incorporation of a company in the Philippines

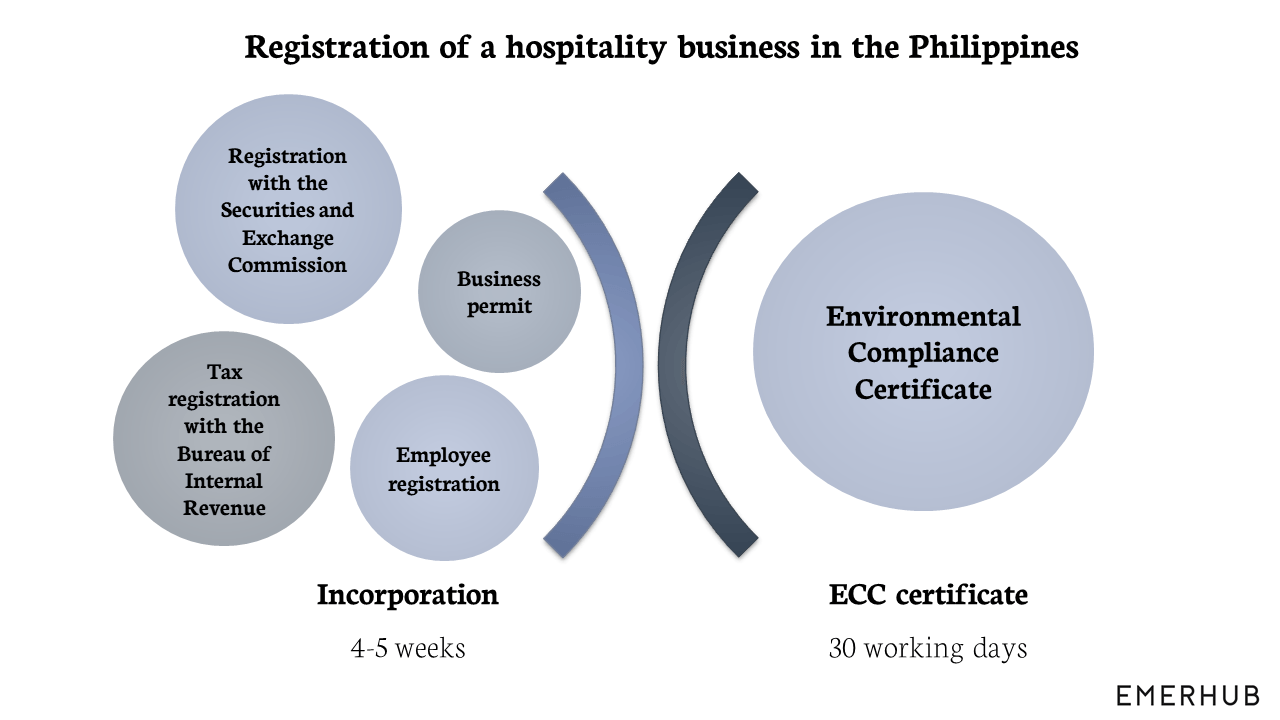

The process of company registration in the Philippines starts with verifying your company’s name and preparing the documents for the Securities and Exchange Commission and finalizing tax and employee registration.

The process of registering a company in the Philippines usually takes 4-5 weeks.

Emerhub can prepare your documents and fully handle the process of company registration on your behalf so you can focus on developing your strategies instead of dealing with paperwork and learning local regulations.

Read more on how to set up a corporation in the Philippines.

#2 Environmental Compliance Certificate

Before your hospitality business can operate in the Philippines, it also needs to acquire an Environmental Compliance Certificate (ECC).

An ECC is necessary for certifying that your business activities will not cause any negative effect on the environment. In general, the Department of Environment and Natural Resources and the Environmental Management Bureau will issue the certificate within 30 working days.

There is a list of requirements on what you need to provide when applying for an ECC, including:

- Project description

- Environmental impact and management plan

- Geotagged photographs of the project site

- Affidavit of no complaint

- Etc.

Contact us via [email protected] or fill in the form below to start registering a company in the Philippines.

Foreign land ownership in the Philippines

“Can foreigners own land in the Philippines?” is one of the most frequent questions among foreigners looking to invest in the area.

By the real estate law, foreign nationals cannot own land in the Philippines. The Investor’s Lease Act, on the other hand, allows foreign investors to lease land in the Philippines for up to 50 years only, and renewable for up to 25 years.

In the case of tourism projects, however, the investment must be at least US$ 5 million, 70% of which you need to realize within 3 years from the start of the lease contract.

If a corporation wishes to purchase land in the Philippines, a Filipino needs to own at least 60% of the shares. Fortunately, there are also a few exceptions to this 60/40 domestic corporation requirement.

Contrary to highly regulated land acquisition in the Philippines, however, foreign nationals can buy buildings and condominiums on their own.

Tax incentives in the Philippines

Also, make sure that you check the available tax incentives when embarking upon the process of registering your hospitality business in the Philippines. This way you will ensure that you maximize the benefit of doing business in the Philippines.

Emerhub can help to determine whether your business could be eligible for tax incentives the Philippines offers for tourism businesses.

Get started with setting up a resort or a hotel in the Philippines

Contact our consultants via the form below to start setting up a tourism business in the Philippines. Emerhub will help you make a successful market entry to the Philippines.