Table of contents

Despite a challenging environment in the world and ongoing tensions between the United States and China, as well as Russia and Ukraine, Vietnam’s economy has shown resilience. This is because of a strong domestic demand for manufacturing, an increase in Foreign Direct Investment and a record-breaking growth in its private sector. The government’s mix of focus for facilitating locally-lead and locally-owned organisations, as well as reforms that welcome international investors, have spearheaded Vietnam into one of the top performing economies in the region.

“The Russia-Ukraine conflict does not have a significant direct impact on foreign investment in Vietnam because the investment of Russia and Ukraine only accounts for a small proportion of the total investment capital, accounting for 0.23% of total investment capital, but has an indirect effect through high prices and causes supply chain disruptions.”

Representative of the Foreign Investment Agency

A Record Breaking FDI and GDP Growth

The Ministry of Planning and Development’s data showed that as of June 20, 2022, the total newly registered capital from FDI for the year reached 14.03 billion USD. This is as much as 91.1% over the same period in 2021.

Vietnam’s Gross Domestic Product also grew 7.72% yoy in Q2 of 2022. The growth is faster than a marginally revised 5.05% growth in Q1. This trend points to the the third straight quarter of expansion in 2022.

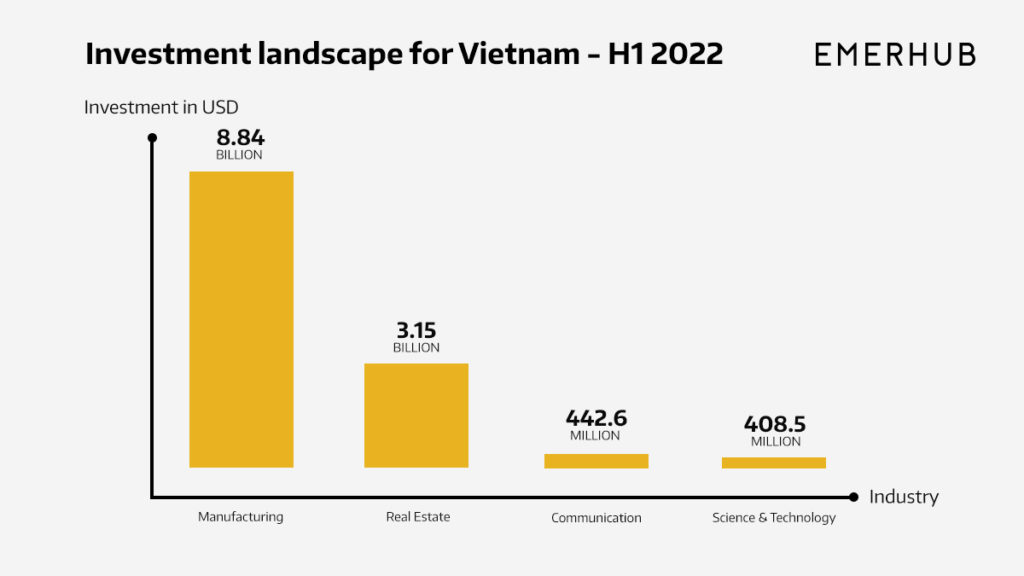

In the first six months of 2022, foreign investors funded 18 industries out of a total of 21 national economic sectors. The processing and manufacturing industry continued to lead with a total investment of nearly 8.84 billion USD. This accounts for nearly 63% of the total registered investment capital. The real estate sector ranked second with total investment capital of more than 3.15 billion USD. This accounts for 22.5% of total registered investment capital.

National Strategy on Foreign Investment

The Vietnamese Government has also approved its 10-year National Strategy on Foreign Investment. For the period 2021-2030, The National Strategy aims to improve the business environment of Vietnam to draw more foreign investors and attract higher quality investments, including high-tech and the digital sector. It will target investments from top investors such as Japan, China, Taiwan, South Korea and Southeast Asian nations, as and ones from the EU. The Strategy puts forward 9 solutions to leverage foreign investment cooperation.

- Improve the business investment environment, and improve the economy’s quality, efficiency, and competitiveness.

- Developing an ecosystem of science, technology, and innovation.

- Innovating and enhancing competition in attracting foreign investment.

- Developing supporting industries, promoting linkages, and spreading.

- Promote internal capacity and take advantage of competitive advantages to improve the efficiency of foreign investment cooperation.

- Improve the efficiency of international economic integration and Vietnam’s position in the international arena.

- Modernize and diversify investment promotion.

- Improve the effectiveness and efficiency of state management of the foreign investment.

The strategy also includes the following:

- Develop the country’s innovation ecosystems: to speed up the implementation of the Resolution 52/NQ-CP issued in 2020 by the government on how the country shall approach the Industry 4.0 Revolution; to introduce incentives for cooperation and technology transfers; to complete the legal framework on the establishment, protection, and commercialisation of intellectual property (IP) rights in scientific, technological and creative activities.

- Foster supporting industries: to continue to improve the legal environment for technology transfers by building a synchronous document system; to promote the formation and development of intermediary organizations; to facilitate the forming of joint ventures and linkages between foreign-invested enterprises and domestic research institutes and universities.