Table of contents

Bangladesh with its strategic location, affordable labor costs, and competitive production costs offers plenty of business opportunities to foreign investors.

A common question among foreign investors aiming to establish a business in Bangladesh is what is the minimum capital requirement here?

In this article, we are going to bring clarity and explain the minimum capital requirement for setting up a foreign company in Bangladesh.

Types of capital for companies in Bangladesh

There are two types of capital for companies in Bangladesh, authorized and paid-up capital.

Paid-up capital is the amount of money that a company receives from its shareholders. This is in exchange for shares of the company and can only be in the form of remittance to the company’s bank account.

Authorized capital refers to the maximum amount of allowed capital that a company can raise. The stated authorized capital is not fully used to leave room for the future increase of capital.

Neither paid-up capital, nor authorized capital has a minimum or maximum limit in Bangladesh. However, you need to declare the amount of both of them in your company’s Articles of Association.

How much is the minimum paid-up capital in Bangladesh?

The law does not set the minimum paid-up capital requirement in Bangladesh. For this reason, the amount of USD 1 (~BDT 84) is considered as the minimum capital requirement in Bangladesh.

Only keep in mind that if you intend to hire any foreign employees, you need to make an inward remittance of USD 50,000. Until then, your capital can be lower than that.

Compared to other similar markets, such as Indonesia or the Philippines, the USD 50,000 remittance requirement in Bangladesh is still relatively small.

| Country | Minimum capital requirement |

| Indonesia | ~USD 170,000 |

| Philippines | ~USD 200,000 |

| Bangladesh |

~USD 1* However, subject to USD 50,000 inward remittance if employing foreign employees |

When to inject the capital contribution in Bangladesh

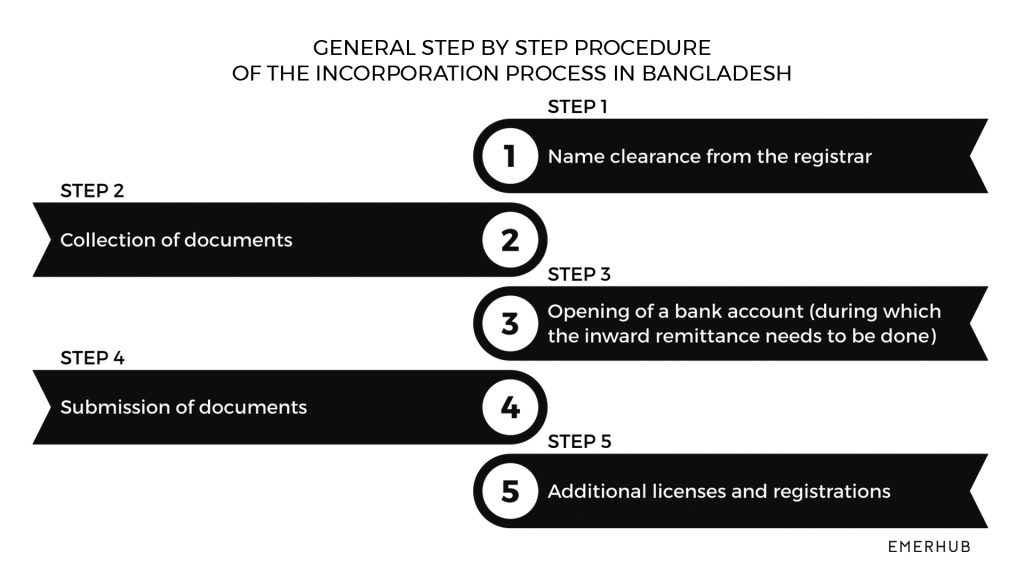

When setting up a company in Bangladesh, the time to inject the paid-up capital is during incorporation. Company registration in Bangladesh begins with getting a name clearance certificate from the Registrar of Joint Stock Companies and Firms (RJSC).

After you get the name clearance certificate from the RJSC, your next step is to proceed to incorporation.

During incorporation, you need to open a bank account in the proposed name of your company. In order to complete the incorporation process, you must inject the capital and get the encashment certificate.

Setting Up A Company in Bangladesh

There are various types of legal entities that foreign nationals can choose from that vary in the minimum number of shareholders, allowed foreign ownership, and allowed activities.

Private Limited Company

This type is the easiest to register and mostly preferred by foreign investors. A private limited company requires at least two shareholders. The capital contribution limits the shareholders’ liability.

Public Limited Company

It takes at least seven (7) shareholders in order to be registered. A public limited company is always part of the stock exchange. Hence, it is always part of their list.

Therefore, its shares are accessible to the public.

Alternatives to setting up a company in Bangladesh

Branch Office

A branch office in Bangladesh serves as an extension to the parent company. Hence, the parent company incorporates the branch office. The parent company shoulders every liability that the branch office incurs.

When it comes to activities, the branch office can engage in commercial activities. As long as they have the approval of the assigned government body.

A branch office does not need a paid-up capital. However, branch offices are also subject to the USD 50,000 inward remittance if they plan on employing foreign employees.

Liaison or Representative Office

A liaison office, or a representative office, is another type of legal entity in Bangladesh. It only serves as a communication or coordination instrument of the parent company in Bangladesh.

Hence, it is always the parent company who incorporates the liaison office.

A representative office does not have any capital, however, it is still subject to a minimum of USD 50,000 inward remittance when employing foreign employees.

Unlike the branch office, the liaison office cannot earn any income from local sources. It is entirely dependent on the parent company. The parent company shoulders all expenses and other operational costs through remittance.

If you’re looking forward to setting up your own business in Bangladesh, feel free to communicate with us through the form below. Or, read about company registration in Bangladesh.