Table of contents

One of the key factors of a sustainable business is its accurate tax compliance. In this article, we will introduce you to tax planning in Indonesia and give an overview of the taxes (foreign) companies need to pay.

Overview of Corporate Taxes in Indonesia

Corporate Income Tax

Companies are liable to Indonesian tax obligations if their domicile is in Indonesia. The standard corporate income tax in Indonesia is 25%. However, there are exceptions and tax planning allows you to significantly reduce the amount of income tax you have to pay.

|

Corporate Income Tax |

Tax Rate |

|

Standard rate |

25% |

| Public company with at least 40% of its shares traded on the Indonesia Stock Exchange |

20% |

|

Small companies with an annual turnover of less than 50 billion IDR |

12,5% |

| Small companies with an annual turnover less than 4,8 billion IDR |

1% |

Tax payments are settled by direct payments, third-party withholdings, or by a combination of both.

Understanding Withholding Tax System in Indonesia

Most of the income taxes are collected through a tax withholding system. The employer is responsible for withholding the income tax and paying it directly to the state treasury on their employee’s behalf. This also includes other types of payments (e.g fees for services) besides salary.

Some types of income payments to resident taxpayers are subject to either 15% or 2% tax withholding.

| Withheld Tax Rate |

Types of Income Subject to Withholding |

|

15% |

Interest, royalties, dividends, prizes and awards |

|

2% |

Remuneration for services; rentals (except buildings and land) |

Corresponding income payments to non-resident individuals are subject to 20% tax withholding. These payments include:

- Interest

- Royalties

- Dividends

- Periodic payments (e.g pensions)

- Service fees

- Prizes and awards

What is the DGT 1 Form

Indonesia has concluded Double Taxation Agreements with 67 countries to relieve double taxation. These tax treaties enable exemptions for service fees for companies without a permanent establishment in Indonesia. Decreased tax tariffs apply to royalties, dividends, interests, and income received by the tax residents of the associate country.

The foreign company must present the Certificate of Domicile (DGT 1 Form) to receive the reduced tariffs. Without submitting the DGT 1 Form, 20% tax will still be withheld.

Value-Added Tax (VAT)

Selling products and delivering services in the Indonesian Customs Area is subject to Value-Added Tax. VAT rates vary from 5-15%, the standard rate being 10%. The export of services, tangible and intangible goods are exempt from VAT.

If a company has branches located in different tax office jurisdictions, it must register each of them with the relevant office.

VAT Liability

In Indonesia, you do not have to be VAT liable but you will want to if your revenue comes mostly from other Indonesian companies. Voluntary VAT liability obliges you to charge VAT on your products and services, however, it also entitles you to reclaim VAT that you have been charged by others.

The regulation of the Ministry of Finance Number: 197/PMK.03/2013, dated December 20, effective 1 January 2014 stipulates that VAT liability is required if the annual revenue exceeds 4,8 billion IDR (~360,000 USD), previously 600 million IDR (~45,000 USD).

Overview of Payroll Taxes and Tax Reporting in Indonesia

Personal Income Tax

Income earned by an individual who is on a payroll in Indonesia is subject to personal income tax. Non-residents of Indonesia are subject to a 20% withholding tax on income earned from Indonesia.

Normal individual income tax rates in Indonesia:

|

Individual Income |

Tax Rate |

| Up to 50 million IDR |

5% |

| Over 50 million to 250 million IDR |

15% |

| Over 250 million to 500 million IDR |

25% |

| Over 500 million IDR |

30% |

*Some industries requiring a large amount of workforce have different tax rates in effect until December 2017

Two types of tax liable individuals are distinguished: resident and non-resident.

A tax resident in Indonesia is an individual who

- lives in Indonesia for more than 183 days in a period of 1 year

- lives in Indonesia during a financial year

- plans to reside in Indonesia

If the above-mentioned requirements are not met, the person is considered as a non-resident of Indonesia.

Social Security Systems

The government of Indonesia has implemented a social security program to provide comprehensive protection to all Indonesian citizens, including expats who live and work in Indonesia for more than 6 months.

The program consists of two schemes: National Manpower Security Agency (BPJS Ketenagakerjaan) and National Healthcare Security Agency (BPJS Kesehatan) which covers up to 5 family members.

Workers are provided with a pension plan and retirement benefits, compensations in case of work-related injuries and death. These benefits are calculated based on the monthly salary and deducted from the payroll together with the employer’s contribution.

Read more about social security and tax compliance in Indonesia.

Tax Reporting

Accurate, regular accounting and tax reporting are vital business procedures in order to comply with the current Indonesian tax regulations. It also optimizes the amount of tax you have to legally pay.

Tax reporting takes place monthly and annually. All the required taxation documents should be submitted to the local tax office in the region where your company is registered.

Emerhub provides professional accounting and tax reporting services to ensure that your company’s payroll taxes and tax reporting are in compliance with the latest laws and regulations in Indonesia.

See the list of our tax reporting services and contact our accountants here.

How to Pay Taxes in Indonesia

When to Pay Taxes

Taxes in Indonesia are to be paid on a monthly or quarterly basis. Monthly paid taxes include Corporate Income Tax, Personal Income and other withheld taxes, VAT, and Luxury Goods Sales Tax (tax applicable to goods considered as luxury products, such as cars, houses, etc).

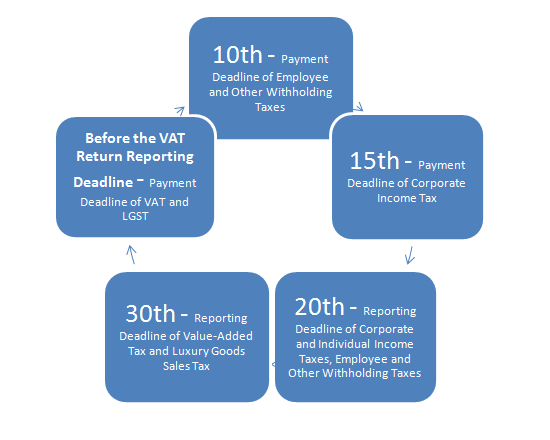

Monthly Tax Payment Schedule in Indonesia

Annually paid taxes are Land and Building Tax, Corporate Income Tax and Individual Income Tax.

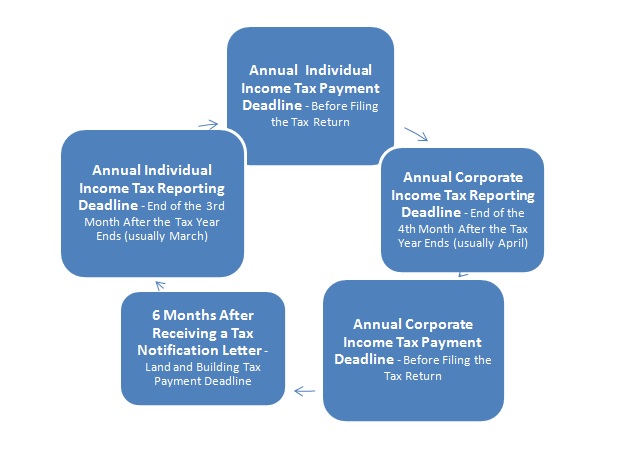

Annual Tax Payment Schedule in Indonesia

Tax Reporting in Bali

Tax reporting requirements for companies having employees on a payroll in Bali are the same as in the rest of Indonesia.

Corporate Income Tax, Withholding Taxes, VAT, and LGST must be paid every month. Annual tax obligations include Corporate Income Tax, Individual Income Tax, Land and Building Tax.

Closing Thoughts

Keeping track on tax reporting and payment deadlines must be accurate and detailed. However, Indonesian laws and regulations can be quite complex and often-changing. Non-compliance entails interest penalties from 2% to 48% per month.

Handling tax issues does not have to be the company’s concern – many companies outsource tax consultants in Indonesia.

With Emerhub’s team of experienced accountants and legal associates, you can be sure that your company’s tax obligations will be well taken care of and you pay the optimal amount of taxes.

Contact Emerhub via [email protected] or by filling out the form below.