Table of contents

In this article, we will shed light on why foreign investors use nominee shareholders in Indonesia, what are the main risks of doing so and how to do it in a safe way.

What is a nominee shareholder?

A nominee shareholder is a person or a company that is the registered holder of shares of a company on behalf of the real owner. However, the ownership is simply ostensible and the nominee shareholder is essentially a name on the documents.

2 main reasons why companies use nominee shareholders in Indonesia

#1 Foreign ownership restriction in Indonesia (Negative Investment List)

The maximum allowed foreign ownership in Indonesia depends on the business classification of the company. It can be from 100% open to totally closed to foreign ownership.

The allowed foreign ownership is regulated by the Negative Investment List (DNI). This means that in order to start a business in an industry that falls under the negative investment list, foreign investors need to have a local partner.

Due to these limitations, it is common practice that investors look for alternative solutions to start a company in Indonesia with the desired amount of control.

#2 Minimum capital requirement in Indonesia

The second reason why many investors choose to opt for nominee shareholders in Indonesia is the minimum capital requirement for foreign companies.

To start a foreign company in Indonesia, investors need to submit an investment plan for at least Rp. 10 billion (~US$ 750,000) to show the sustainability of their business. Rp. 2.5 billion (~US$ 190,000) of the investment plan, however, needs to be paid up immediately.

When all shareholders of the company are local nominees, on the other hand, the capital requirements are a lot lower.

Read our previous article to learn more about the minimum capital requirement in Indonesia.

Unsafe nominee arrangements

Not all uses of nominee shareholders are safe nor smart. In fact, using an unreliable nominee is one of the 7 common mistakes foreign investors make when setting up a company in Indonesia.

Using an individual nominee shareholder, especially without a legal set of agreements, is risky mainly because it does not give you full control over your assets. Furthermore, it would essentially be based on blind trust. Most commonly such agreements are made with friends, family or co-workers hoping it will work out well.

However, this does not mean that all nominee arrangements are unsafe. The right kind of nominee agreements is a set of complex legal agreements that protect your assets and are drafted by professionals, provided by professional service companies such as Emerhub.

Investment law on nominee arrangements in Indonesia

The Indonesian Investment Law does not recognize the concept of “trust” or “trustee” in the common law system. The owner of the shares who is stated in the Articles of Association (AKTA) of a limited liability company is both the beneficial and the legal owner. Hence, there is no distinction between them.

Additionally, the BKPM has issued the newest regulation No.13 of 2017, emphasizing in Article 12 (6,7) that investors are not allowed to make any agreements which state that they are not the owners and, if needed, to supply a notarial statement confirming such.

Therefore, nominee arrangements and games with business classifications are out. So what is the safe way of having nominee shareholders in Indonesia?

Nominee company in Indonesia

Nominee company service allows you to set up a company in Indonesia under the requirements established for local companies and also to have total control over the company’s assets and earnings through a set of legal agreements.

Emerhub provides a nominee company package using corporate shareholders. It has many advantages, greatest of them are that:

- it allows you to sign agreements that comply with Indonesian laws

- these agreements hold up at court

- minimizes risks compared to using individual nominees

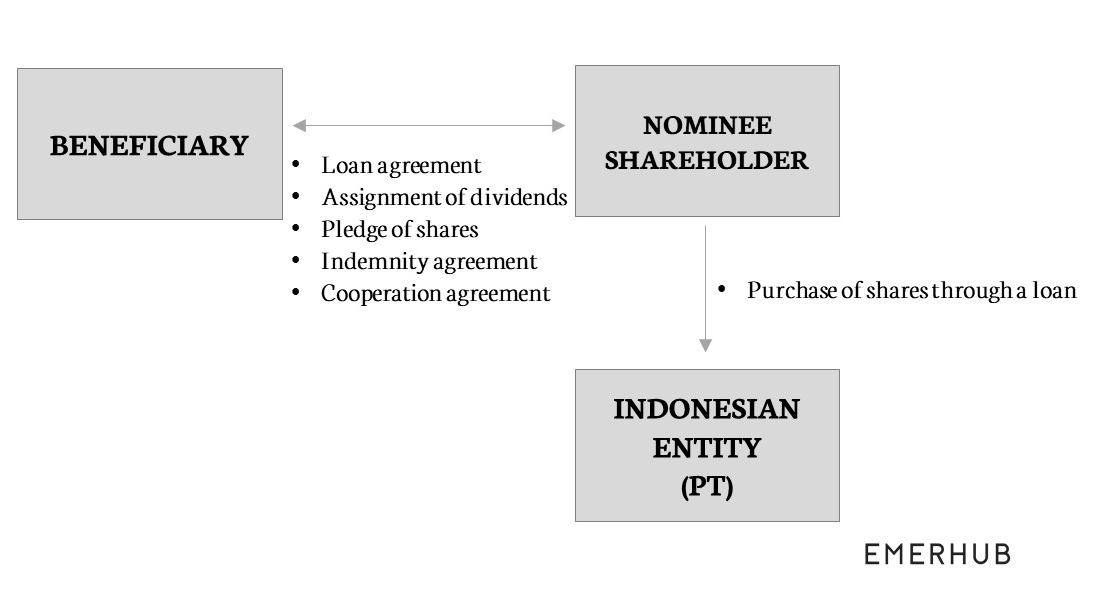

The relations between the nominee shareholder and beneficiaries are commercially governed by a loan agreement where the nominee is purchasing the shares in the company by using a loan provided by the beneficiary.

Since the shares are purchased through a loan, they are pledged back to the beneficiaries for total control.

How to use nominee shareholders in Indonesia the safe way

This gives you peace of mind that you can run a business in a restricted sector without breaking any laws and also have a local partner you can trust and who is governed by the signed agreements.

Our nominee company service is billed annually and can be extended as long as needed by the investor.

Alternatives to nominee companies in Indonesia

Representative office

As an alternative to incorporation, you can also set up a representative office. Representative offices don’t need to comply with capital nor ownership requirements in contrast to PT PMAs.

However, as representative offices’ purpose is to only represent an overseas company, it cannot earn any revenue in Indonesia.

Differences between a nominee company and a PT PMA

|

Nominee company |

Foreign-owned company (PT PMA) |

|

|

Legal entity type |

PT (locally owned) |

PMA (foreign-owned) |

|

Paid up capital requirement |

(~US$ 3,800) in case you hire only local employees

|

Rp. 2.5 billion (~US$ 190,000) |

|

Maximum foreign ownership |

No foreign ownership allowed |

0-100%, depending on your industry |

|

Legal owner in Articles of Association |

Emerhub based on loan agreement with you |

You |

|

Control over assets |

Director of the company (can be you) |

Director of the company |

|

Change shareholders whenever necessary |

Yes |

Yes |

Also, see our guide on how to register a company in Indonesia for more information about PT PMAs.

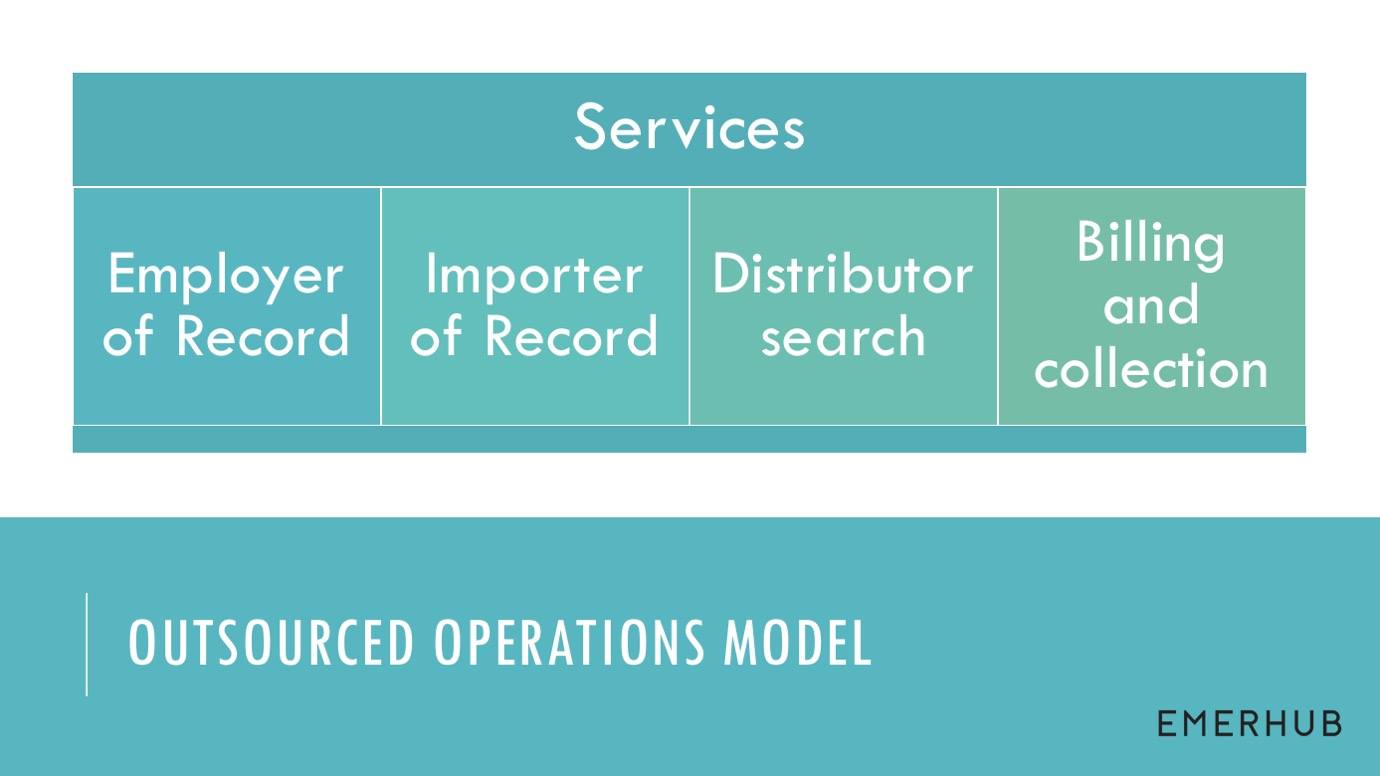

Outsourced operations model

Incorporation may not always be the best or also the fastest way to start doing business in Indonesia. For example, if you wish to test the market first. In that case, outsourced operations model can help you out.

It allows you to provide services, conduct sales and also to earn revenue, etc. without setting up a legal entity in Indonesia.

Some of the services included in our outsourced service model are, for example:

Bringing it all together

For any additional questions regarding nominee companies in Indonesia or setting up a company in Indonesia, contact us via the form below. We will be happy to discuss how we can help your business in Indonesia.