Table of contents

Indonesia’s current principal electricity generation capacity is around 53.6 GW/ Gigawatt (53,600 MW) and is currently targeting to have an additional 35 GW (35,000 MW) of capacity over the next five years.

Such massive growth is attracting both local and foreign investors to invest in both traditional and renewable energy production.

In this article, we will guide you how you can invest in hydro or solar power in Indonesia.

Demand of Electricity in Indonesia

The electricity demand in Indonesia keeps increasing at around 6% each year and is predicted to increase by 2 to 3% in the following years.

There are currently around 12.6 million households out of 254 million populations in Indonesia who currently have no access to public electricity and the government is struggling to provide electricity for them.

The electricity in Indonesia depends mostly on oil, which belongs to fossil fuel generation (non-renewable energy resources) and has been identified as the main reason to the high level of pollution/ CO₂ emissions in the country.

To promote the growth of clean and Eco-friendly way of living, the country has started a rapid development of renewable energy, especially in hydro and solar power as the alternative energy for generating electricity in Indonesia.

To build a greater role in hydro and solar power in Indonesia, the government of Indonesia has set out plans as follows:

| Completing The Upper Cisokan Pumped Storage Hydroelectric power plan (4 x 260 MW) project in West Java by 2016. This plant will be the first of its kind in Indonesia |

| PLN to secure financing for construction of the Jati Gede Hydroelectric power plant (2 x 55 MW) in West Java and the Merangin Hydroelectric Power Plant (2 x 90 MW) in the province of Bengkulu, Sumatra |

| PLN and IPPs to add 3 pump-storage power plants in Java to increase the hydropower capacity in Indonesia and provide spinning reserves and system stability |

| Under the 10,000 MW Accelerated Development of Electricity Generation, the country is committed to build two hydropower plants in North Sumatra and West Sulawesi to increase Indonesia’s total large hydropower capacity to 3,804 MW, or 5% of Indonesia’s total hydropower potential of about 75,000 MW |

Indonesia has now also become an active participant in the ASEAN Energy Awards Program (incl. the Best Practice for Energy Efficient Buildings and the Best Practice for Energy Management in Buildings and Industries).

The Energy Alternatives in Indonesia: Hydro and Solar Power

Hydro and solar power work as the alternatives model to Indonesia’s decentralized electricity generation.

They can be renewed and the best thing about them is they will not reduce any amount of energy resources they use for generating electricity. The solar power generation for example, will no reduce any amount of sun radiation on Earth to produce electricity, unlike fossil fuel generation plant. The country’s existing hydropower has also been proven to burn no fuel and does not produce greenhouse gas (GHG) emissions, other pollutants or wastes associated with fossil fuels or nuclear power.

Indonesia’s Renewable Energy Potential

The potential of renewable energy resources in Indonesia is far beyond the potential of natural gas, oil and coal, and this clearly confirms hydro and solar power potential in Indonesia.

The Presidential Regulation No. 5 of 2006 on the National Energy Policy mandates an increase in renewable energy production from 7% to 15% of generating capacity by 2025. It states the contribution of hydro and solar power will be at 2%, in which the government will take measures to add the capacity of micro hydro power plants to 2,846 MW by 2025 and solar of 0.87 GW by 2024.

Hydropower Potential

Indonesia is among the top ten countries with the biggest global technically potential hydropower in the world with development of micro, mini, small and large plants over the past years.

Hydro contributed 12.9TW/h to total electricity supply in 2005. The current installed capacity for all hydro plants is about 4,260 MW or 5.8% of the total hydro energy potential, as shown in the table below.

| Potential and Installed Capacity of Hydropower | |||||||

| No. | Location |

Large Scale (>10 MW) |

Small Scale (<10 MW) |

Total (MW) |

|||

| Potential | Installed Capacity | Potential | Installed Capacity | Potential | Installed Capacity | ||

| 1. | Sumatera | 16,100.00 | 1,154.00 | 281.76 | 83.44 | 16,381.76 | 1,237.44 |

| 2. | Java | 12,050.00 | 2,012.50 | 222.02 | 212.32 | 12,272.02 | 2,224.82 |

| 3. | Kalimantan | 5,999.50 | 30.00 | 277.75 | 31.27 | 6,277.25 | 61.27 |

| 4. | Sulawesi | 14,550.00 | 352.00 | 167.56 | 118.05 | 14,717.56 | 470.05 |

| 5. | Bali- Nusa Tenggara | 4,900.00 | 0.00 | 31.64 | 12.25 | 4,931.64 | 12.25 |

| 6. | Maluku- Papua | 21,057.00 | 23.00 | 32.78 | 4.67 | 21,089.78 | 27.67 |

| Total | 74,656.50 | 3,571.50 | 1,013.51 | 462.00 | 75,670.01 | 4,033.50 | |

Micro- hydro is a type of hydroelectric power that typically produces from 5KW to 100 KW of electricity, This type of power generation is gaining popularity in Indonesia and has increased by more than 700% since 2000.

There are currently 450 MW of micro- hydropower within the country and the government will take measure to add the capacity of the particular power plant to 2,846 MW by 2025.

In developing micro hydro, the government needs to integrate the micro- hydropower plants with the local economy, maximizing the irrigation potential for the power plant and developing the domestic micro hydro industry, and developing several partnerships and funding patterns.

Minister of Energy and Mineral Resources (MEMR) has also issued Minister of Energy and Mineral Resources Regulation No. 19 of 2015 on The Purchase of Electric Power by PT Perusahaan Listrik Negara (PLN). The Power Generated from Hydropower Plant with capacity of maximum 10 MW (Micro- Hydropower Projects) shall be effective as of 29 June 2015, as follows:

| Tariff for Micro- Hydropower Using Power of River’s Flow Up To 10 MW | |||||

| No. | Power Plant Capacity | Location | Purchase Price/ Feed-in-tariff

(USD/ kWh) |

F Factor | |

| 1st to 8th Year | 9th to 20th Year | ||||

| 1. |

Medium Voltage (up to 10 MW) |

Jawa, Bali and Madura | 12.00 x F | 7.50 x F | 1.00 |

| 2. | Sumatera | 12.00 x F | 7.50 x F | 1.10 | |

| 3. | Kalimantan and Sulawesi | 12.00 x F | 7.50 x F | 1.20 | |

| 4. | Nusa Tenggara Barat and Nusa Tenggara Timur | 12.00 x F | 7.50 x F | 1.25 | |

| 5. | Maluku and Maluku Utara | 12.00 x F | 7.50 x F | 1.30 | |

| 6. | Papua and Papua Barat | 12.00 x F | 7.50 x F | 1.60 | |

| 7. |

Low Voltage (up to 250 KW) |

Jawa, Bali and Madura | 12.00 x F | 7.50 x F | 1.00 |

| 8. | Sumatera | 12.00 x F | 7.50 x F | 1.10 | |

| 9. | Kalimantan and Sulawesi | 12.00 x F | 7.50 x F | 1.20 | |

| 10 | Nusa Tenggara Barat and Nusa Tenggara Timur | 12.00 x F | 7.50 x F | 1.25 | |

| 11. | Maluku and Maluku Utara | 12.00 x F | 7.50 x F | 1.30 | |

| 12. | Papua and Papua Barat | 12.00 x F | 7.50 x F | 1.60 | |

Solar Power Potential

Indonesia is a rising manufacturing power and could easily become the world’s largest manufacturer of solar panels and related solar products.

As a country that is located in equator line, Indonesia has an abundant resource of solar energy that is suitable to use in small islands, remote areas, and border areas where there are no existing electricity installation.

Other solar potentials may include that it is great for rural electrification as it out-competes diesel in the daytime and the diesels will be out-competed by solar also at night in rural areas. A huge opportunity is for solar water heating as most water heating is done with gas that is bottled, not piped – Indonesia needs fresh water and solar can be used to desalinate water.

The most beneficial potential of solar power is that it is inexpensive and getting less expensive each year, which is good for a developing nation with per capita income of about USD5000 per person each year.

There are currently 4.80 KWh/m2/day solar power in Indonesia, and the government will take measures to add the capacity of solar power of 0.87 GW by 2024.

The 3 alternatives of solar project implementation scheme available in Indonesia includes the following:

- Solar Photovoltaic (PV) or Solar Home System (SHS)

- Centralized PV Power Plant

- Hybrid System (combination of solar PV and other existing resources – diesel power in particular)

Indonesia’s total solar photovoltaic/ solar home system (SPP/SHS) installed capacity was 13.49 kW or increased by 55.6% from 2008, as shown below.

| No. | Location | Capacity/ Year (kW) | ||||

| 2005 | 2006 | 2007 | 2008 | 2009 | ||

| 1. | Sumatera | 0.33 | 0.78 | 1.69 | 2.65 | 4.28 |

| 2. | Java | 0.33 | 0.40 | 0.53 | 0.78 | 1.15 |

| 3. | Kalimantan | 0.16 | 0.38 | 0.71 | 1.11 | 1.93 |

| 4. | Sulawesi | 0.12 | 0.64 | 1.37 | 1.98 | 2.85 |

| 5. | Bali- Nusa Tenggara | 0.12 | 0.35 | 0.62 | 1.00 | 1.41 |

| 6. | Maluku- Papua | 0.16 | 0.36 | 0.71 | 1.15 | 1.87 |

| Total | 1.22 | 2.91 | 5.63 | 8.67 | 13.49 | |

To encourage the participation of foreign companies in investing in solar industry in Industry and to develop and boost utilization of solar energy, the government is taking the following responsibility:

- Using solar powered power plants in the rural and city areas

- Supporting the commercialization of solar powered power plants by maximizing the private sector role

- Development of domestic solar powered power plants industry

- The creation of an efficient funding system through the involvement of the banking sector

- Finalizing the draft of the Ministerial Regulation regarding feed-in-tariff (FIT) in the field of solar power. FIT scheme offers more incentives towards investors who can maximize the local content (min. 40%) in their product

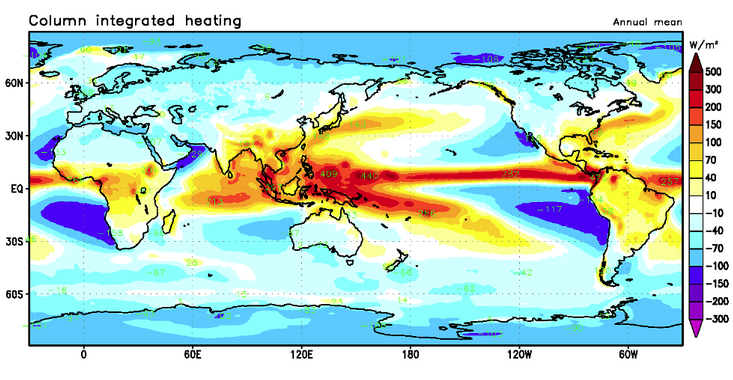

Moreover, the country itself owns additional options from solar thermal – see the chart above and look at how much energy is surging around the country.

Why to Invest in Hydro and Solar Power in Indonesia

Indonesia’s renewable energy potential that we have explained above was projected by the International Energy Agency (IEA) as one of the most promising benefits for domestic and foreign investors to invest in hydro and solar power in Indonesia.

So far, Indonesia’s also been reported as a country with a stable political system with a growing economy in which to do business – projects range from large-scale power plants with power purchase agreements (PPAs) negotiated with PLN, the state- owned utility company, to development projects coordinated by multilateral development banks or local government.

There is a significant portfolio of small hydro projects in planning or under construction.

Hydro sites under 10 MW will likely receive significant private interest following the change in the law requiring PLN to purchase power from plants up to 10 MW.

To reach government’s target electrification ratio of 99.4% by 2024, Indonesia requires 70 GW of new generating capacity or about 7 GW per year on average, and with this high demand in electricity along with the Ministerial Regulation No. 1122 of 2002 on Small- Scale Power Purchase Agreement gives out opportunities for cooperatives, private and government companies in selling power to PLN known as PSK Tersebar- by means your renewable energy sources are at the country’s high demands.

Notably, this regulation requires PLN to purchase electricity generated from renewable energy sources by non-PLN producers for projects of up to 1 MW capacity.

Foreign Investment Ownership in Power Generation

PLN is the state- owned electricity company in Indonesia that works on behalf of the government and is responsible for providing electricity across the whole of Indonesia and for developing the electricity sector.

The power generation sector in Indonesia is dominated by PLN that controls around 70% of generating assets in Indonesia, and with this role however, PLN is not allowed to have a monopoly on supplying and distributing to end customers.

Instead, a license to provide electricity for public use (IUPTL) may be granted to (among others) private business entities, subject to a ‘right of first priority’ provided to state- owned companies (i.e., PLN).

PLN remains as the sole owner of transmission and distribution assets of electrical power until the enactment of Indonesia’s 2009 Electricity Law and GR No.14 of 2012 (as amended by GR No. 23 of 2014) that allows for private participation in the supply of power for public use and open access for both transmission and distribution.

Private sector participation is allowed through Independent Power Producer (IPP) arrangements. Electricity business licenses for public use (IUPTLs) can be offered to IPPs with up to 95% foreign shareholding when generating more than 10 MW of electricity, and this has been increased to 100% foreign shareholding if constituting a PPP project.

For small-scale power plants generating 1 to 10 MW there is a 49% foreign shareholding cap and power plants generating less than 1 MW are closed to foreign investment.

Investors who generate electricity for their own use rather than for sale to PLN are known as Private Power Utilities (PPUs), and they must hold an operating license (Izin Operasi) to generate, transmit and distribute electricity for their own use or to their own customer base. The PPU may sell excess capacity to IUPTL holders (i.e., PLN) or directly to end- customers subject to the approval of the relevant Minister, Governor or Mayor.

The 2009 Electricity Law and Ministry of Industry Regulation No. 48 of 2010 require holders of an IUPTL or an Electricity Supporting Services/ Industry License to prioritize the use of local content.

The following table summarizes the minimum local content for hydro and solar sources of power generation, as stipulated by the Ministry of Industry Regulation No. 54 of 2012.

| Power Plant | Capacity | Min. of local content (TKDN) | ||

| Goods | Services | For combination of goods and services | ||

| Hydro | Up to 15 MW | 64.20 | 86.06 | 70.76 |

| > 15 to 50 MW | 49.84 | 55.54 | 51.60 | |

| > 50 to 150 MW | 48.11 | 51.10 | 44 | |

| Above 150 MW | 47.82 | 46.98 | 47.60 | |

| Solar Home System | Per unit | 30.14 | 100 | 53.07 |

| Solar Public | Per unit | 25.63 | 100 | 43.85 |

The 2009 Electricity Law and its implementing regulations (GR No. 14 of 2012 as amended by GR No. 23 of 2014, GR No. 42 of 2012 and GR No. 62 of 2012 therefore offer a greater role for regional government and other entities to participate in this business. Some key differences between the 2009 Electricity Law and the Previous Law are as follows:

| Key Provisions | Previous Law | Present Law |

| Electricity Supply Licensing |

|

|

| Tariff |

|

|

| Cross- border sale and purchase |

Not regulated |

|

| Direct sale of electricity to the public |

|

|

Foreign investors wishing to participate in the power sector must first obtain a foreign investment license from The Investment Coordinating Board (BKPM) pursuant to the Investment Law No. 25 of 2007.

To do this, an Indonesian incorporated entity must be established and licensed as a PT PMA company.

Starting in 2015, once the PT PMA Company is established the company must apply through BKPM’s for an IUPTL license and other licenses (such as the permanent business license and principle license).

Under Presidential Regulation No. 39 of 2014, the Negative List also prescribed foreign investment limitations in the power sector as follows:

| Power Sector | Foreign Ownership Allowance |

| Micro Power Plants <1 MW | Closed for foreign investment |

| Small Power Plants (1 to 10 MW) | Max. 49% |

| Power plants with a capacity of >10 MW | Max. 95% or 100% for PPP projects |

| Power transmission and distribution | Max. 95% or 100% for PPP projects |

| Power supply construction and installation (incl. consultancy) and O&M services | Max. 95% |

| Power usage installations and testing/ analysis of power installations | Closed for foreign investment |

Overcoming Barriers to Successful Hydro and Solar Power Investment

The government of Indonesia is seeking to create an investment climate that is capable of attracting foreign investors. Coupled with a sound fiscal policy and strong domestic consumption, this commitment has increased foreign interest in the Indonesian market.

However, investors still face significant challenges, which include import restrictions, insufficient infrastructure and regulatory uncertainty.

The key barrier to scaling up clean energy projects in Indonesia continues to be the difficulties associated with achieving acceptable rates of return on investment.

Despite the regulations mentioned earlier, it remains challenging for investors to invest in hydro and solar power.

The key issues to hydro and solar power investment includes the following:

- Demand side energy efficiency must overcome the low cost of electricity

- The limited buying power of the majority of energy consumers

- The lack of fuel efficiency standards, all of which suppress investments to reduce power and fuel consumption

- Supply side energy efficiency projects in the power sector are possible and can be scaled up by working with PLN, but they must compete for capital with investments needed to expand generating capacity to meet growing demand

- Challenges to negotiate and sign power purchase agreements with the local PLN office where the project will be located (i.e., projects that want to sell power to the Java- Bali grid must compete with relatively low power generation costs

- Pressures in negotiating purchase agreements and long-term power purchase agreement from PLN

- Difficulties for investors in energy conservation (i.e., the inadequacy of knowledge, absence of information, lack of in- depth management skills, the concentration of decision making at the top level and lack of clarity in how to calculate the tariff and the know-how in proposal preparation)

- Struggle of obtaining land- use permissions, subsidized tariffs and uncertain regulatory environment

As a result to the above-mentioned issues, FDI has thus far not kept pace with investments in renewable energy industry.

PLN’s status as the sole legal provider of electricity through Indonesia’s power grid in particular, has also complicated the incentives for foreign developers and often limits the profitability of projects.

There is also a lack of an after-sales service infrastructure and a strong transmission infrastructure for grid- connected renewable energy projects. Therefore, Indonesia lacks quality data and there is a need to verify would need a third- party like our company for valuation.

Emerhub has been active in Indonesia for years and have developed significant working relationship with the Indonesian government and private sectors.

For companies that are new to renewable energy market, working with an established company like us can be an effective means of entering the market. For companies interested in joint partnerships, Emerhub is willing to cooperate, and together we could discuss the capacity and capital required to develop large-scale renewable energy projects.

Emerhub could improve the confidence of private firms in the electricity sector in Indonesia by making the process of negotiation with PLN more transparent.

We work by negotiating with PLN to sell power significantly lower than the cost of production and within the long-term contracts we will do a careful planning in order to administer in today’s volatile fuel market that necessarily involves multiple layers of government.

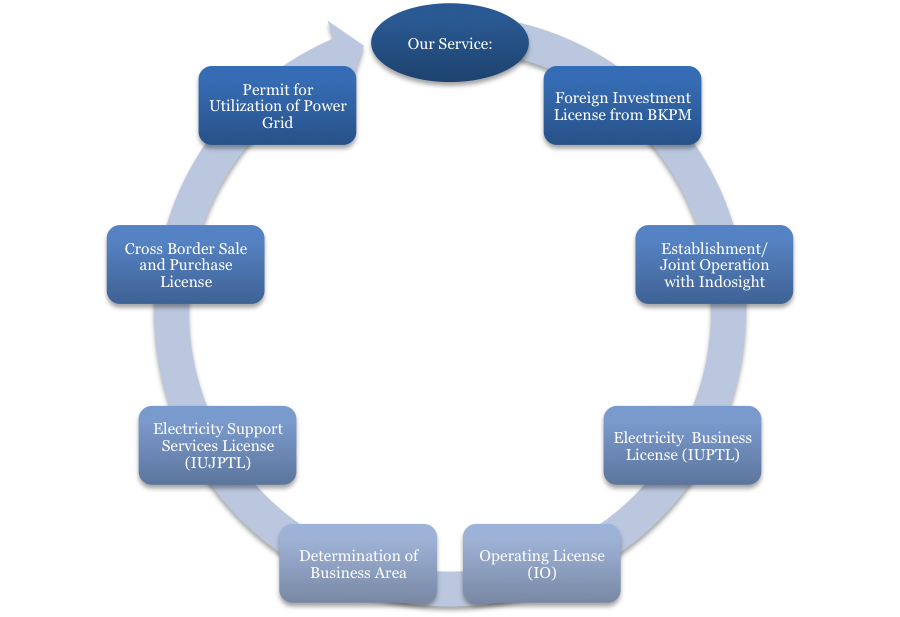

The following flow chart will help you recognize our service in obtaining your IUPTLs and other power related licenses for you in entering the hydro and solar power sector industry in Indonesia.

After helping you in obtaining licenses and permits needed to operate within the industry, we then provide you ongoing support to help facilitate your smooth investment.

This service may consist of:

- Finding you parties who would like to use the network

- Helping you calculate your tariffs and access price to be approved by the relevant authority (Minister, Governor or Mayor) and et cetera.

This article concludes the benefit of not requiring fuel is also to simplify the operational logistic. By investing in hydro and solar power in Indonesia, the government and remote area in Indonesia no longer need to deal with corrupt officials that smuggle precious fuel.

Contact our investment professional today – [email protected] and we will show you comprehensive details of hydro and solar power investment opportunities in Indonesia.

As we are committed to your investment success, Emerhub will help you review some basic asset class characteristics, the return expectations and provide you with the best legal advises for your hydro and solar power investment plan.