Table of contents

Choosing franchising as your market entry strategy enables you to start a new business or expand your company to new markets by using existing and tested brand names and business models.

In Vietnam, foreign investors can participate in franchising both as franchisors as well as franchisees. This article demonstrates the process of setting up a retail business and gives you an overview of franchising in Vietnam.

Requirements for franchising in Vietnam

The only prerequisite for foreign franchisors engaging in franchising business in Vietnam is that the business that will be franchised must be registered for at least 1 year in their jurisdiction before franchising in Vietnam.

Registration with the Ministry of Industry and Trade

According to Vietnam’s franchising law, foreign franchisors (companies registered overseas) need to register their franchise activities with the Ministry of Industry and Trade (MoIT).

Not doing so will result in a monetary fine, generally between VND 5-10 million (~US$ 220-440). This amount may seem small, however, in more severe cases, the franchisors must return the profits gained from franchising activities.

Registration with the Ministry of Industry and Trade does not necessarily mean that you need to incorporate a company in Vietnam. It is possible to expand your franchise to Vietnam without registering a company here.

Emerhub can assist you with forming an agreement with your franchisee in Vietnam and with the registration at the MoIT. Contact us via [email protected] to start with franchising in Vietnam.

Also, note that domestic franchisors do not have the obligation to register with the Ministry of Industry and Trade.

Becoming a foreign franchisee in Vietnam

Foreign investors can also become franchisees in Vietnam. However, pay attention that the business line you want to engage in must be open to foreign ownership.

For example, if you want to open a hotel in Vietnam and provide tourism services as well, you need to form a joint venture with a local tourism company that also has an international tourism license.

On the other hand, if you want to open a restaurant or a retail outlet, it is a lot easier as they can be 100% foreign-owned in Vietnam.

Franchise agreement in Vietnam

The Vietnamese law does not require any particular provisions to be included in the franchise agreement. The franchisor and the franchisees are free to negotiate the terms and conditions of the franchise agreement.

Also, the Vietnamese law does not have to be the governing law of your franchise agreement. You can choose a foreign jurisdiction as well. Only make sure the provisions stipulated in the agreement aren’t contrary to laws in Vietnam.

Also, keep in mind that the Decree 35/2006/ND-CP states that the franchise agreement must be written in Vietnamese. This requirement also applies if you choose a foreign jurisdiction.

Renewal of the franchise agreement

The law does not stipulate any conditions in terms of the contract or renewal of the contract. This should be negotiated by the parties.

For this reason, you should examine all agreements very carefully beforehand to avoid costly inconveniences in the future. Emerhub can assist you with the necessary legal advice.

Taxes on franchising in Vietnam

If you don’t register a company in Vietnam but you are collecting fees from the franchisees, you are a foreign contractor in Vietnam. Therefore, you are subject to withholding tax on any fees collected, including but not limited to:

- Franchise fees

- Royalties

- Administrative fees

- Advertising fees

- Management fees

Foreign franchisors in Vietnam are also subject to the following withholding taxes for services in Vietnam:

- Value-Added Tax (VAT) 5%

- Corporate Income Tax (CIT) 5%.

Domestic franchisors, on the other hand, are subject to:

- Value-Added Tax (VAT) 10%

- Corporate Income Tax (CIT) 20%

Read more about tax reporting in Vietnam here.

Registering a trademark in Vietnam

When expanding to Vietnam as a franchisor, it is also wise to register your trademark with the National Office of Intellectual Property of Vietnam in order to keep your brand safe.

To learn more about the topic, read our previous article about trademark registration in Vietnam.

Setting up a retail business in Vietnam

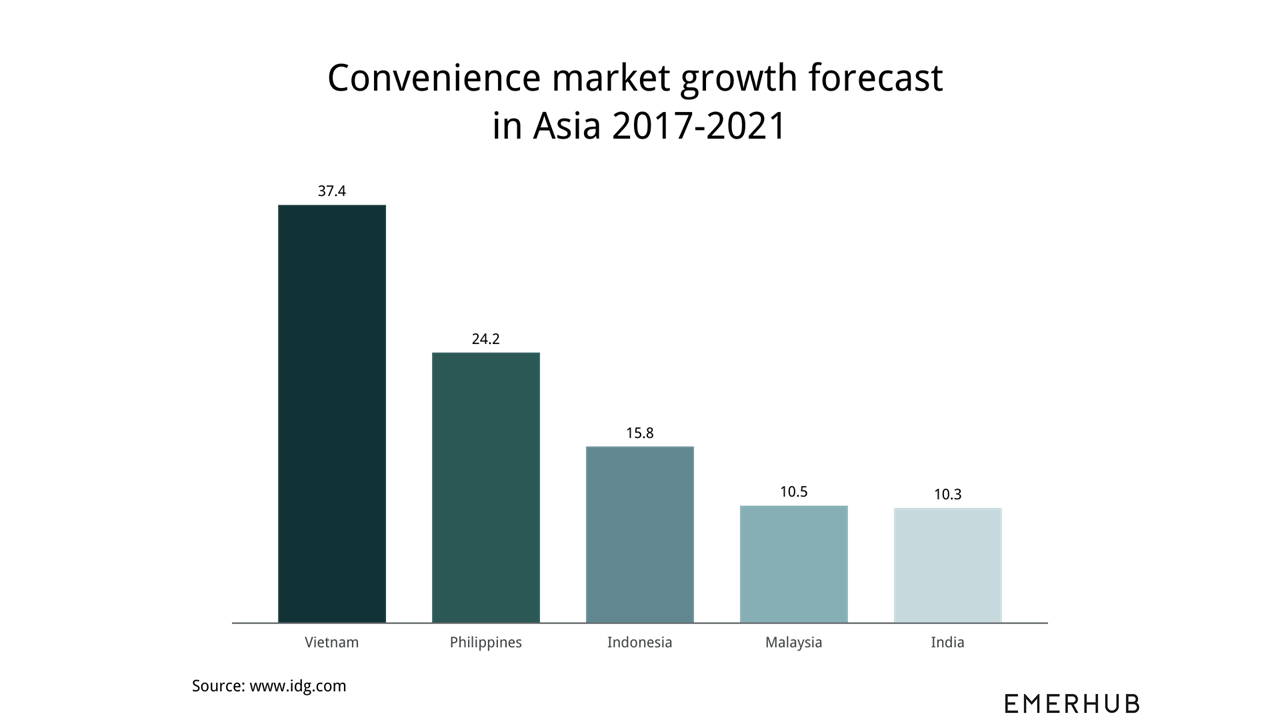

A report released by the international grocery research organization IGD predicts that by 2021, Vietnam’s convenience store market will grow by 37.4%, making Vietnam the fastest-growing convenience store market in Asia.

And, as the retail business line in Vietnam is fully open to foreign investment, you can establish a retail business without having a local partner.

Minimum capital requirement for retail businesses in Vietnam

There is no official minimum capital requirement for most business lines in Vietnam. However, keep in mind that your expenses must be in compliance with your expenses for establishing a retail business here.

For example, you need to have sufficient capital if you’re planning on building retail outlets as well.

How to register a retail store in Vietnam

#1 Obtain an investment registration certificate

The first step of registering any foreign company in Vietnam is to get the primary license for doing business here – an investment registration certificate.

The certificate will be granted by the Department of Planning and Investment (DPI) and it is the primary license for conducting business activities in Vietnam.

#2 Acquire a business registration certificate

The second obligatory license you need to obtain in order to register a company in Vietnam is the business registration certificate.

Once the Department of Planning and Investment has granted you one, you have 90 days to make the initial capital contribution.

#3 Registration of retail outlets

The third step of establishing a retail business in Vietnam is the registration of your retail outlets. If you want to open more than one outlet, all need to register your outlets in all locations.

If the locations are in different provinces of Vietnam, you need to open branches in those respective provinces.

Also, note that if you need to import any goods, you have to obtain a trading license in Vietnam which will approximately take 6 weeks to obtain.

Emerhub will instruct you on what documents you need to collect. Furthermore, we will also submit the documents and communicate with the authorities in Vietnam on your behalf. Your presence in Vietnam is only necessary once.

Also interested in doing e-commerce business? Take a look at our guide to launching an e-commerce business in Vietnam.

How to start with franchising in Vietnam

For any further questions or to get started with franchising in Vietnam, contact us by filling in the form below. Our consultants will gladly assist you with expanding your business in Vietnam.