Table of contents

With one of the world’s largest unbanked communities and increasing Internet connectivity, Indonesia fosters a fertile ground for fintech businesses.

If you plan on investing in – or launching – a fintech company in Indonesia, this article will give you an overview of the current market situation and regulations.

Indonesia’s fintech regulations

The growth of the Indonesian fintech space is swift, but not unregulated. The central institutions overseeing fintech companies in Indonesia are Bank Indonesia and the Financial Services Authority, also known as Otoritas Jasa Keuangan (OJK).

The Indonesia Central Bank focuses on digital payments, including eWallet, eMoney, payment gateways, cryptocurrencies, and card issuers and acquirers, amongst others.

The OJK, on the other hand, regulates lending, crowdfunding, online financing and all other aspects of fintech. The exact requirements vary, depending on the type of fintech business you want to establish.

The majority of the focus in Indonesia’s fintech landscape is on online payments and lending. Therefore, for this concrete example, we will look at how to set up a P2P lending company in Indonesia.

To learn more about the process of setting up any other type of fintech company in Indonesia, reach out to our consultants via [email protected] for an individual consultation.

Top fintech startups in Indonesia

Indonesia has proven to offer lucrative opportunities for several fintech companies. Some of the most notable fintech startups in Indonesia are:

|

Company |

Services |

|

Akulaku (PT Akulaku Silvrr Indonesia and PT Akulaku Finance Indonesia) |

Digital credit-related services |

|

Kredivo (PT FinAccel Teknologi Indonesia and PT FinAccel Digital Indonesia) |

Digital credit payments |

|

CekAja (C88) |

Financial product comparison |

|

Modalku (Funding Societies) |

P2P lending for SMEs |

|

P2P lending |

|

|

Mobile point-of-sale transactions (mPOS) for SMEs |

Why set up a P2P lending company in Indonesia

Indonesia implemented its first peer-to-peer lending regulation in 2016. According to data from Indonesia’s Financial Services Authority (OJK), P2P transactions in Indonesia reached Rp. 13.8 trillion (~US$ 974 million) in the first three quarters of 2018.

What are the most important aspects contributing to this tremendous growth?

#1 Large number of unbanked Indonesians

According to the latest Global Financial Inclusion Index (Findex), financial inclusion in Indonesia showed the best progress in Southeast Asia. However, 95 million Indonesians out of the country’s 270 million people are still unbanked.

Moreover, 33% of the Indonesians who are unbanked cite distance as a key reason for not having an account – a gap that online lending companies could fill.

#2 Increasing Internet access

An average Indonesian spends 8 hours and 51 minutes a day online, according to the 2018 Global Digital Report.

54% of Indonesians now have access to the Internet. Connectivity is on the rise both in urban areas (72,94%) and rural areas (48.2%). The latter statistic is especially promising for opportunities to increase mobile payment and transactions.

Combined with over 95 million unbanked Indonesians who would not be able to get a loan from a traditional bank due to their non-existent credit history, the rapidly growing proportion of tech-savvy Internet users can bring highly rewarding opportunities for P2P companies.

#3 Southeast Asia’s largest economy with a robustly expanding middle class

Another main driver that attracts foreign investors to invest in Indonesia is the country’s rapidly growing middle class.

Currently, 52 million people comprise the Indonesian middle class. By 2030, McKinsey predicts the Indonesian middle class to reach 90 million consumers.

#4 P2P lending is organically part of the Indonesian culture

A growing number of solvent consumers with an increasing demand for consumer goods consequently increases the necessity for fast credit.

As people are accustomed to borrowing money from friends, neighbors, and local loan sharks to finance their cash problems, P2P fintech companies will provide a solution by serving as the digital version of lending.

Why you need to secure licenses for your fintech business in Indonesia

Bear in mind that the OJK keeps a careful eye on the sector, entering the Indonesian fintech market without obtaining proper permits will result in business closure.

A special task force by the OJK has recently tracked down and exterminated 227 unlicensed P2P lending companies in Indonesia. Therefore, if you plan on establishing a peer-to-peer lending company in Indonesia, make sure to have all the necessary permits in order.

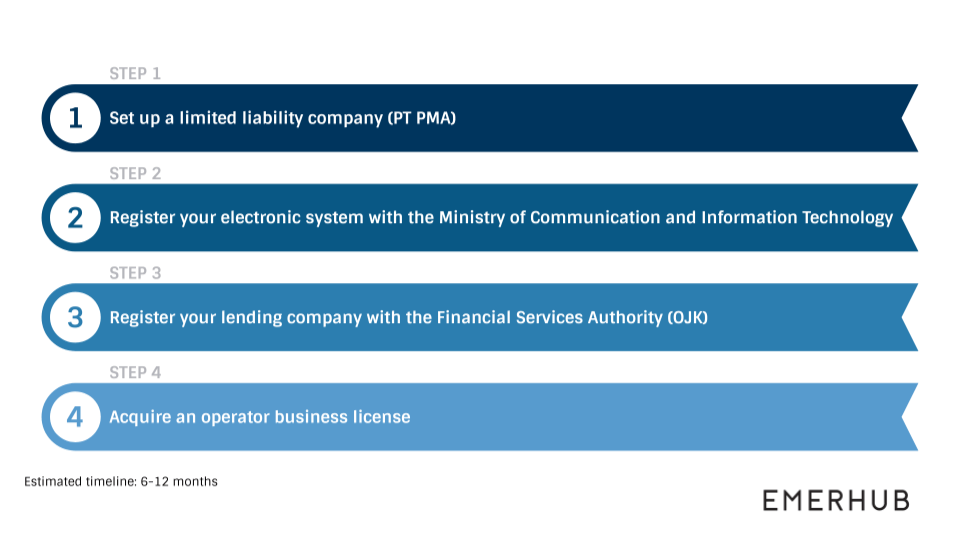

How to set up a fintech company in Indonesia

Step 1: Set up a limited liability company

To apply for money lending licenses in Indonesia, you need to first set up a limited liability company. Marlissa Dessy, the Director of Emerhub, explains the most important aspects of company registration in Indonesia in this brief video:

Foreign ownership restriction on P2P companies in Indonesia

The maximum foreign share ownership of fintech companies is capped at 85%, which means that you need at least one Indonesian shareholder.

One option here is to use a local nominee shareholder. However, be sure to choose a trustworthy nominee and always have the supporting paperwork. In fact, trusting an unreliable nominee is one of the top mistakes foreign investors make when setting up a company in Indonesia.

The safest option for using nominee shareholders is to set up a nominee company. With a nominee company, the shares will be pledged back to you, thus removing risks associated with unsafe nominees, while allowing you to meet foreign ownership limitations.

Share ownership and shareholder structure

The minimum Indonesian company structure requires two shareholders, one Commissioner, and one Director. The Commissioner must be an Indonesian citizen, and both the Commissioner and the Director must show managerial experience in the financial sector.

Minimum capital requirement in Indonesia

The minimum paid-up capital for a foreign company in Indonesia is IDR 2.5 billion (~US$ 170,000). During incorporation, there are two ways to prove the capital. You can either by sign a capital statement letter or transfer the money to your company’s bank account.

Note that laws and regulations in Indonesia change often. For a complete guide on how to set up a company in Indonesia, read our always-up-to-date guide to setting up a PT PMA or contact our consultants via [email protected].

Once the limited liability company is set up, your P2P fintech company will need three more licenses before it can start operating in Indonesia.

Step 2: Kemkominfo registration

The first step after incorporation is to register your IT system with the Ministry of Communication and Information Technology, also known as the Kemkominfo. Kemkominfo is responsible for aspects of fintech that fall under information technology.

Step 3: OJK license

The second additional permit will be to register your fintech company with Indonesia’s Financial Services Authority (OJK) and acquire the OJK license. It requires, along with a completed form:

- Deed of Incorporation

- Proof of Commissioner and Director identities

- Certificate of Company Registry

- Evidence of operational readiness of business activities in the form of documents related to Electronic system used by Operator and operational data

- Proof of capital requirement fulfillment

- The statement of the settlement plan on the rights and the obligations of the user if OJK does not approve the licensing of the operator

Step 4: Operator business license

Third and last additional license that you need is the Operator Business License. You can apply for this license after registering your business with the OJK, and you must apply for it within one year of the OJK registration date.

Ready to launch a fintech company in Indonesia?

While Indonesia is quickly becoming an exciting and profitable market for the financial sector, setting up or investing in fintech is not without its hurdles.

For this reason, Emerhub is pleased to assist every step of your process, from performing due diligence, to setting up your business or even hiring IT developers.

For more information, don’t hesitate to contact us through the form below.